In this article, we will discuss Varun Beverages share price target 2024 to 2030, quarterly result, financials and fundamentals, future plans, and challenges depending on the various reports from research and brokerage firms.

Table of Contents

Introduction

Due to this strong result, instead of falling market, Varun beverages rose 2.78% on Tuesday, 22 October 2024. Varun Beverages’ net profit beat the market estimate and rose to Rs 628.8 crore in the July-September Q2 period. Bloomberg estimated the profit of Rs 557 crores. The company’s net profit rose 22% year-on-year to Rs 628.8 crore in Quarter 2.

Quarter 2 Performance

Varun Beverages was listed on the stock market on November 8, 2016; since then, it has delivered more than 2,169.10% returns to its investors. Despite rainy weather in India, the company has still managed to grow by 5.7%. After the announcement of quarter 2 result VBL share price has jumped up 4% significantly. VBL share price is trading in the range of Rs 600-625 per share.

Revenue has increased 25.25% to R 4804.7 crore.

Operating income has grown by 30.59% year on year.

Net profit has increased 22.3% to Rs 628.8 crore.

Diluted EPS has grown by 25.82% year on year.

Stock Performance

Compounded sales growth is 35% in the last 3 years.

Compounded Profit Growth is 77% in the last 3 years.

Stock price CAGR is 75% in the last 3 years.

Return on equity is 30% in the last 3 years.

Company overview

Varun Beverages and PepsiCo have been associated since the 1990s, and over the two and a half decades, this partnership is still making record profits. Varun Beverages is engaged in manufacturing, distribution, and selling a wide range of carbonated soft drinks, including packaged drinking water.

The company sells the product under the trademark of PepsiCo. The company generated its 76% revenue from carbonated soft drinks, 16% revenue from packaged drinking water, and 8% fruit juice-based drinks.

Products:

- Pepsi

- Lipton Ice Tea

- Aquafina

- Tropicana

- Sting

- Mirinda

- 7UP

- Mountain Dew

- Tropicana

Fundamentals

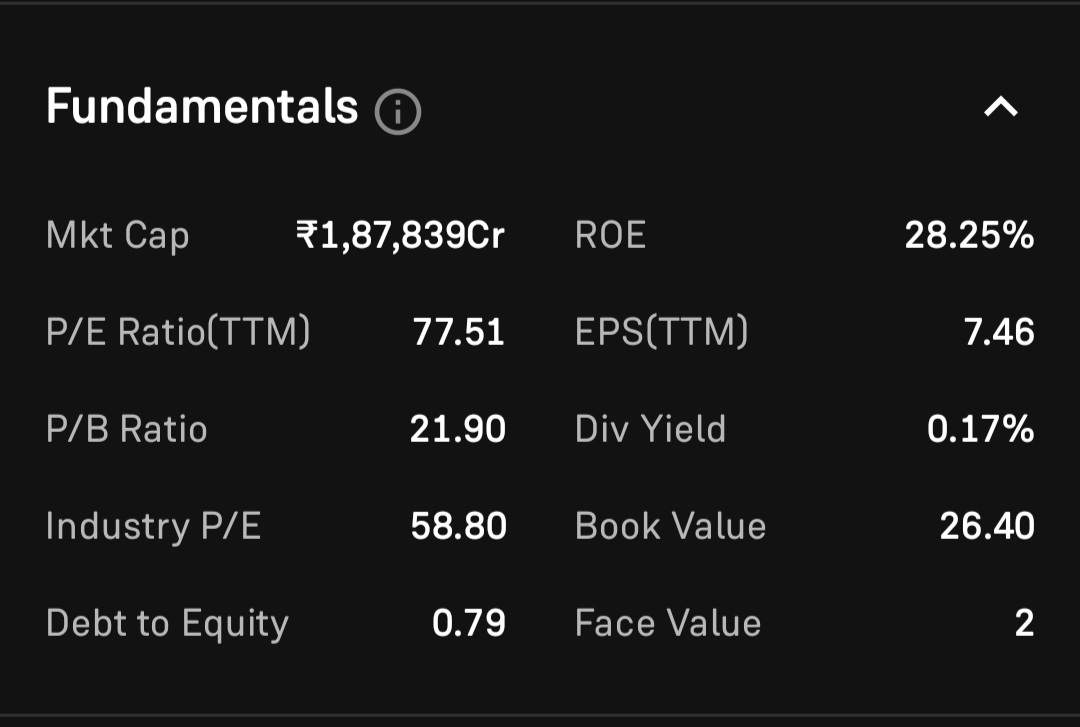

Varun Beverages has a market cap of Rs 1,87,839 crore with P/E Ratio of 77.51 while industry P/E is 58.80. Debt to Equity is 0.79 and Return on Equity is 28.25%. Dividend Yield of Varun Beverages is 0.17%.

Net-profit margin-

Revenue of Varun Beverages is rising consistently, and profit is increasing also.

| Year | Revenue | Profit |

|---|---|---|

| 2023 | 16,122 | 2,102 |

| 2022 | 13,212 | 1,550 |

| 2021 | 8,891 | 746 |

| 2020 | 6,487 | 357 |

| 2019 | 7,172 | 472 |

Share holding pattern

Foreign Institutions and Mutual Funds have a significant shareholding in Varun Beverages, with retail participation of 8.18% in Sep’24.

| | Sep’24 | Jun’24 | Mar’24 | Dec’23 |

|---|---|---|---|---|

| Promoters | 62.66% | 62.66% | 62.91% | 63.09% |

| Foreign Institution | 24.18% | 25.32% | 25.78% | 26.58% |

| Retail | 8.18% | 7.46% | 7.16% | 6.75% |

| Mutual Funds | 2.63% | 2.42% | 2.26% | 2.31% |

| Domestic Institution | 2.34% | 2.12% | 1.89% | 1.28% |

Share price targets for Varun Beverages are highly speculative and influenced by numerous factors, such as market conditions, economic indicators, company performance, industry trends, and many more.

Varun Beverages share price target 2024

The consumers’ buying power is also increasing, hence increase in demand for soft drink products due to urbanization.

| 2024 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 535 | 680 |

| 2nd Price Target | 558 | 710 |

Varun Beverages share price target 2025

In recent years, the Varun beverages has acquired some of the largest retail players, acquiring a diverse portfolio of products.

| 2025 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 650 | 880 |

| 2nd Price Target | 685 | 920 |

Varun Beverages share price target 2026

This global change in appetite for FMCG sector is shaping the strategy of Varun Beverages. Meanwhile, the company is making footprints in overseas business.

| 2026 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 855 | 1260 |

| 2nd Price Target | 930 | 1340 |

Varun Beverages share price target 2030

The company is doing business in several vital sectors, some of which are experiencing rapid growth due to shifting consumer tendencies.

| 2030 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 2235 | 2580 |

| 2nd Price Target | 2355 | 2610 |

Varun Beverages share price target 2035

The company has rapid growth meanwhile, company has issued consistent 5 years stock split or bonus share activity.

| 2035 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 5005 | 5650 |

| 2nd Price Target | 5150 | 5810 |

Competitor

- Hatsun Agro

- Bikaji Foods

- LT Foods

- Zydus Wellness

- Mrs Bectors

- Avanti Feeds

Varun Beverages Challenges

- Raw material pricing: Varun Beverages has reported a 26.4% rise in expenses as inflation is rising day by day. Raw material prices like sugar, flavoring agents, glass bottles, and packaging have increased.

- Global Competition: Varun Beverages has 76.47% business from India and the rest (23.53% from other countries. The company has to maintain its quality so that any other player can’t intervene.

- Upcoming Winter Season: The upcoming winter season is the biggest challenge for the company’s India business because during the winter major parts, especially the north region of India, experience cool weather, so it has an adverse impact on the company’s revenue.

| Join our WhatsApp Channel for latest updates | Stockmoodys |

| Join our Telegram Channel for latest updates | Telegram |

Conclusion

Varun Beverages is a large-cap multibagger stock that has given extra-ordinary returns to its investors. Recently, the company has announced a split in the ratio of 2:5, whose ex-date was 12 Sep 2024. In 2023, Varun Beverages also announced a stock split in a ratio of 5:10. The company has given returns like a small- or mid-cap company, while being a large-cap stock, it’s a very good investment choice from a long-term perspective.

| Flair Share Price Target 2024 to 2030, financials, fundamentals, and more… | Read More… |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not investment advice.

Is Varun Beverages Ltd. a good buy?

Varun Beverages has delivered good returns consistently to its investors. The company has given 959% returns in the last five years. Varun Beverages is a good buy from a long-term perspective.

Is Varun Beverages paying a dividend?

Varun Beverages is paying dividends to investors. Dividend yield is 0.17% of Varun Beverages. The latest dividend of Rs 1.25 per share was delivered on 9 Aug 2024.

Varun Beverages is profitable?

Yes! Varun Beverages is a profitable company. The company’s net profit margin in June 24 is Rs 1,252 crore.

What is the main business of Varun Beverages?

Varun Beverages has produced carbonated soft drink-related products in India and overseas also. The company is offering good-quality products at a marginal rate.

Is Varun Beverages a multibagger?

Yes! Varun Beverages has given a 959% return in the last 5 years and 2,170% all-time returns, so definitely Varun Beverages has proved a multibagger in history.

Nice and detailed info.

Thanks admin