In this article, we will discuss the Sagarsoft share price target for 2024 to 2030, fundamentals, future plans, and challenges depending on the various reports from research and brokerage firms and research analysts.

Quarter 2 Results

The gross sales of Sagarsoft in Q2 of FY24 were Rs 25.5 crore, up by a quarterly growth rate of 12%. It was a clear sign of improvement from previous periods of loss, and for this period, the net profit was Rs 3.5 crore. This performance can be attributed to several key factors:

- Increased Demand for IT Services: There has been a constant demand for IT solutions, especially in the technological frontier that is seen as the current and future market territory, such as digital transformation and cloud computing.

- Effective Cost Management: Some of the cost control measures include the following: The company also recorded higher profitability margins despite increasing operating costs.

- Client Retention and Growth: Sagarsoft maintained most of its big clients while diversifying and offering added services to these customers, which helped in the generation of revenues.

Collectively, these findings suggest that Sagarsoft has favorable momentum and is laid out for future expansion.

Industry Overview

The industry is one of the most significant and rapidly growing industries in India, specializing in IT services. As of 2023, it is projected to reach $350 billion, driven by several key trends:

- Digital Transformation: Most enterprises are directing significant resources to introduce digital tools to improve productivity and customer relations.

- Cloud Computing: Cloud solutions are also facilitating new opportunities for IT service providers as companies increasingly require elastic systems.

- Global Outsourcing: Indian firms have retained their position in outsourcing because of their relatively inexpensive services and qualified personnel.

Company Overview

Established in the year 1999, Sagarsoft India Ltd. is a business solutions provider offering IT solutions, which encompass software solutions, solutions consultancy, and business process outsourcing (BPO). The company has established its good image as an IT services-providing company concentrating on the healthcare, finance, retail, and education industries.

Key Services Offered

- Custom Software Development: Finishing solutions that are aligned with specific business needs.

- Cloud Services: Helping clients with cloud migration and cloud service provision, including control of the cloud environment.

- Data Analytics: Providing ‘’analytical intelligence’’ solutions with an insight that enhances sound decision-making processes.

- IT Consulting: Offering leadership on the most suitable approach to the adoption and deployment of information technology.

Financials of Sagarsoft India

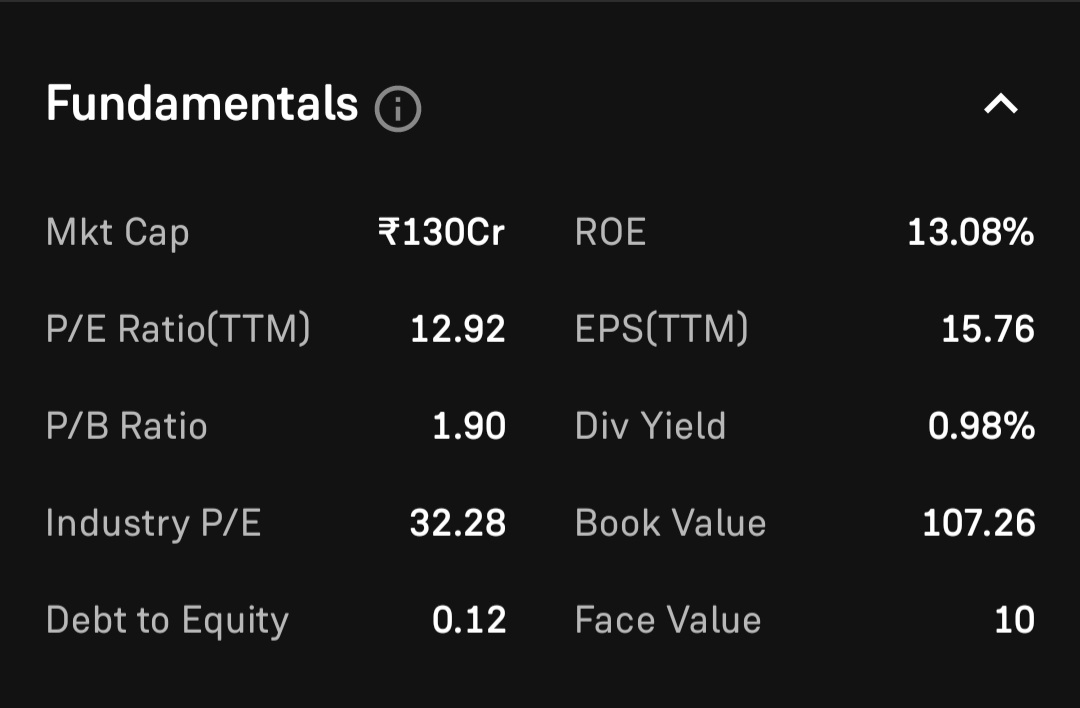

In particular, it is quite important to have a proper analysis of Sagarsoft and its financial performance to make an adequate conclusion about the aimed investment. Here are key metrics from recent reports:

Recent Financial Performance

For the fiscal year ending 2023, Sagarsoft declared their total revenues of about Rs 90 crores and a net profit margin of about 8%. Despite operating in a very competitive environment, the company has proved to be consistent with steady revenue in the past few financial years.

Key financial metrics

Revenue Growth: The manner in which it presented its annual growth data shows that the company has enjoyed a growth rate of reasonably close to 11.42%—a sign of stability.

Profitability Ratios

- Net profit margin: approximately 8%

- Operating Margin: This is at around 8.74%, which we attribute to operational efficiency.

- Debt Levels: Distinctively, Sagarsoft has no debt ratios and has a debt-to-equity ratio of 0, which means it works without any debts. This makes the financial position more secure and unbinds available funds for future uses.

Sagarsoft share price target 2024

Sagarsoft has given 43% returns to its investors in last one year. P/E Ratio of this company is 12.59 while industry P/E is 35.35.

| 2024 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 150 | 240 |

| 2nd Price Target | 165 | 255 |

Sagarsoft share price target 2025

Sagarsoft India limited has 99.45% revenue from global operations and only 0.55% revenue comes from India.

| 2025 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 220 | 350 |

| 2nd Price Target | 236 | 375 |

Sagarsoft share price target 2026

Investing more in Research and Development will ensure that Sagarsoft invents competitive new products and service offerings for new and changing client needs. That is why this focus on R&D will help the company to remain aware of the market trends.

| 2026 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 360 | 550 |

| 2nd Price Target | 375 | 580 |

Sagarsoft share price target 2030

Investment in Technology: Sagarsoft will embrace the latest technologies, such as artificial intelligence (AI) and machine learning (ML), to boost the improvement of service provision and operation. These engagements are critical with regard to competitiveness in the changing environment.

| 2030 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 1545 | 1860 |

| 2nd Price Target | 1610 | 1945 |

Sagarsoft share price target 2035

Expansion into New Markets: The company intends to seek opportunities in overseas markets that have tremendous demand for IT services at the moment. This comprises focusing on areas like North America and Europe.

| 2035 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 3575 | 4230 |

| 2nd Price Target | 3630 | 4410 |

Future Projections

Sagarsoft has set a target of generating revenues of more than Rs 150 crores by FY 26 due to the planned investment in technological solutions and geographical diversification. It is proposed that the competitive advantage is to be driven by the development of more services and the pursuit of more outstanding market share.

Strengths of Sagarsoft

Strong Relationships: Client Some of the strategic developments demonstrated by the company include: The firm has developed partnerships with strategic clients in various industries. This helps to retain clientele and provide predictability in income.”

Skilled Workforce: All these professionals mean that when clients approach Sagarsoft, the company can give its best to ensure that it meets the expectations of the customers.

Innovative Solutions: The corporate strategy of Sagarsoft also pays great attention to innovation due to the constant changes in service portfolios based on markets and technologies.

Debt-Free Status: Lack of debt gives the company the opportunity to invest in new projects without worrying about coming up with payments for the interests.

| Join our WhatsApp Channel for latest updates | Stockmoodys |

Weaknesses of Sagarsoft

Limited Market Presence: Sagarsoft has established itself well in some sectors but has a comparatively less presence in new age sectors as compared to much more prominent players in the market. This could ram constraints on the growth opportunities in the context of rapidly growing regions.

Dependence on Key Clients: Many of the revenues are generated from a few large customers; their loss would directly affect the earnings. In turn, the presence of multiple clients is essential for a stable business.

Moderate Growth Rate: It has been observed that the growth rate of the organization is reasonably good but not at par with the flag bearers of the industry. This may deter investor interest in the stock as they trade with a premium for growth in their investments.

Future Strategies of Sagarsoft India: To enhance its competitive position and drive growth, Sagarsoft has outlined several strategic initiatives:

Enhancing of Research and Development Capacity.

Conclusion

For investors interested in the IT services space, Sagarsoft India appears as an exciting player. The company enjoys a perfect relationship with customers, has qualified and creative personnel, has adopted the policy of being debt-free and is, therefore, poised for future growth.

However, potential investors should have a notion of the risk factors associated with low market exposure and concentration on clients.

| Piramal Pharma share price target 2024 to 2030 | Read More… |

| Amber Enterprises share price target 2024 to 2030 | Read More… |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not investment advice.

FAQs

Should I buy the stock of Sagarsoft?

The results of operations in the last year with strategic measures make Sagarsoft rightfully attract the attention of investors interested in the IT services sector. However, potential investors should cautiously evaluate the market factors before making any investment decision.

Is Sagarsoft a multi-bagger?

Though it has proved itself to be capable of giving huge returns if the top management charts out plans for expansion and they are correctly executed, then the real question is whether or not the company will turn out to be a multi-bagger over time and how the market is behaving during that particular period.

Who is the owner of Sagarsoft?

The company was started by a person named Mr. Raghavendra Rao K., who is the managing director of the software development company and is in charge of managing the company’s strategic development.

Is Sagarsoft debt-free?

Yes, the debt/equity ratio is slightly above 0%, which makes Sagarsoft free from any sort of debt, which is also a favorable condition.

What is the product of Sagarsoft?

Sagarsoft mainly delivers IT solutions and services, including software development solutions, cloud solutions, data analytics, and IT solutions in different sectors, including health care, finance, retail, and education.