In this article, we will discuss the LT Foods share price target for 2024 to 2030, the company’s financials and fundamentals, future plans, and challenges depending on the various reports from research and brokerage firms.

Table of Contents

Introduction

Lalchand Tirathram Rice Mills (LT Foods) was founded by Mr. Vijay Kumar Arora in 1978 in a village in Amritsar, Punjab. LT Today, LT Foods is the leading processor of rice and other specialty foods in India and exports the processed food to 65+ countries, including the US, Europe, Middle East, and Rest of the World. The company has gotten various prestigious awards in the food industry from trusted organizations.

LT Foods has captured about 22% market share in India with his basmati rice with the brand name of DAAWAT, India Gate, and Kohinoor, with the revenue of 7,822 crores in FY24.

Industry overview

Rice is an essential part of food for billions of people. The rice industry is constantly showing innovation and growth. India is the largest producer and consumer of rice. Expected market value is $50 US in 2021. Demand for good-quality rice is increasing with time due to packaged food demand. Price fluctuation is a real concern in this industry.

Stock Performance

LT Foods was listed on NSE on 6 Nov 2023 since then it has delivered more than 100% returns to its investors.

Sale has increased 16.72% YoY basis.

Operating Income has grown by 14.6% CAGR YoY.

Net profit has increased 11.45% YoY.

Company overview

LT Foods worked on a medium scale between 1950 and 1977 as Lalchand Tirathram Rice Mills, incorporated by Raghunath Arora. He wanted to make homegrown basmati rice famous in India. Over the years, LT Foods has grown with the brand name we know as DAAWAT Basmati Rice.

Mr. Vijay Kumar Arora introduced LT Foods globally by keeping the quality consistent and innovating with the times. LT Foods has covered 50% of the of the rice market in the US. LT Foods has its headquarters in Gurugram, Haryana.

LT Foods Ltd. is the owner of India’s most popular brand, “DAAWAT,” in basmati rice. LT Foods has given great returns to their investors, like their great quality of product.

Financials

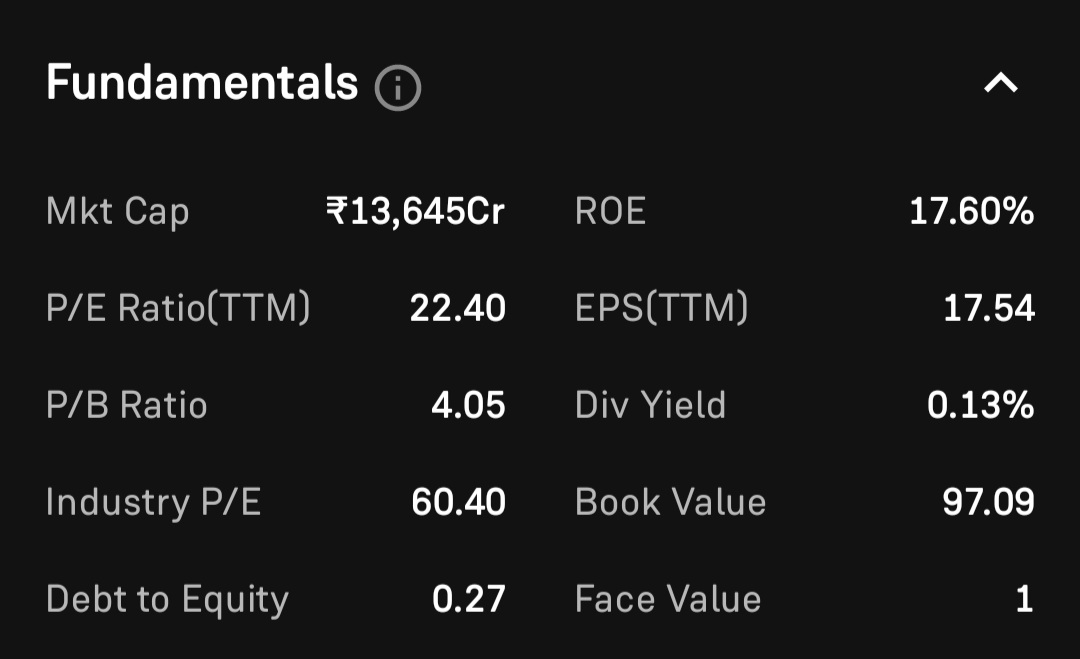

LT Foods has market cap of Rs 13,645 crores. P/E Ratio is 22.40 while industry P/E is 60.40. Debt to Equity ratio is 0.27 and Return on Equity is 17.60%. Dividend yield is 0.13%.

Net-profit margin-

Revenue at LT Foods is rising consistently, and profit is increasing also.

| Year | Revenue | Profit |

|---|---|---|

| 2024 | 7,822 | 598 |

| 2023 | 6,979 | 423 |

| 2022 | 5,451 | 309 |

| 2021 | 4,773 | 289 |

| 2020 | 4,173 | 199 |

Share holding pattern

Foreign Institutions and Mutual Funds have a significant shareholding in LT Foods, with retail participation of 37.44% in Jun’24.

| Jun’24 | Mar’24 | Dec’23 | Sep’23 | Jun’23 | |

|---|---|---|---|---|---|

| Promoter | 51.00% | 51.00% | 51.00% | 51.00% | 51.00% |

| Retail | 37.44% | 39.78% | 40.19% | 37.90% | 39.22% |

| Foreign Institution | 5.88% | 5.14% | 5.73% | 6.02% | 6.48% |

| Mutual Funds | 4.60% | 3.48% | 3.08% | 3.73% | 2.84% |

| Domestic Institution | 1,07% | 0.60% | 0.00% | 1.35% | 0.45% |

Share price targets for LT Foods are highly speculative and influenced by numerous factors, such as market conditions, economic indicators, company performance, industry trends, and many more.

But we will predict the LT Foods Ltd share price target in 2024, 2025, 2026,2030, and 2035 by analyzing the previous performance and after studying various brokerage and research firm forecasts.

LT Foods Share Price Target 2024

LT Foods was listed on the BSE on 18 December 2006. If you visit D-Mart or Reliance Retail stores regularly, then you can observe that Daawat’s product is placed in the front row. The company is using great marketing strategies.

LT Foods share price target will show growth till the price of 490 Rs. The company has shown nice growth.

| 2024 | Price Target |

|---|---|

| 1st Price Target | 440 |

| 2nd Price Target | 490 |

LT Foods share price target prediction for 2024 is based on the company’s financials, previous trends, and various brokerage firm reports.

LT Foods Share Price Target 2025

LT Foods has an expansion plan in African and European countries. After establishing his products in America, Company has targeted the European and African markets. Due to its great product and great marketing strategy, LT Foods share target price can go up to 690 Rs.

| 2025 | Price Target |

|---|---|

| 1st Price Target | 620 |

| 2nd Price Target | 690 |

LT Foods share price target prediction for 2025 is based on the company’s financials, previous trends, and various brokerage firm reports.

| Join our WhatsApp Channel for latest updates | Stockmoodys |

| Join our Telegram Channel for latest updates | Telegram |

LT Foods Share Price Target 2026

Foreign investment is increasing in the company because it has shown tremendous growth. While there are many companies struggling for profitability due to the pandemic situation because of COVID-19. The company still has given profit to its investors. LT Foods Daawat share target price can go up to 1010 Rs in 2026.

| 2026 | Price Target |

|---|---|

| 1st Price Target | 1010 |

| 2nd Price Target | 990 |

LT share price target prediction for 2026 is based on the company’s financials, previous trends, and various brokerage firm reports.

LT Foods Share Price Target 2030

LT Foods gives the best quality of basmati rice. If we have a look at the earnings of Indian individuals, it’s increasing by a significant margin. When an individual earns well, it’s reflected in his lifestyle, so Daawat products will definitely make a place more than others. LT Foods share price target can go up to 3590 Rs in 2030.

| 2030 | Price Target |

|---|---|

| 1st Price Target | 3410 |

| 2nd Price Target | 3590 |

LT Foods share price target prediction for 2030 is based on the company’s financials, previous trends, and various brokerage firm reports.

LT Foods Share Price Target 2035

LT Foods share price can hit 9410 Rs. in 2035. The company’s revenue and profit are increasing on a year-on-year basis. Mutual funds also have invested in this stock with a significant percentage. LT Foods has clear goals of expansion and new product launch. Product acceptance is increasing day by day.

| 2035 | Price Target |

|---|---|

| 1st Price Target | 9410 |

| 2nd Price Target | 9350 |

LT Foods share price target prediction for 2035 is based on the company’s financials, previous trends, and various brokerage firm reports.

Competitor

- Amira Nature Foods – Amira

- Adani Wilmar Ltd., Fortune

- India Gate Foods—India Gate

- Kohinoor Foods, Kohinoor

- Lal Qilla

LT Foods Challenges

- Raw material pricing: LT Foods has the biggest challenge to be competitive in the market with this pricing because, as inflation is rising day by day, the raw material price will also increase.

- Global Competition: LT Foods has only 31.03% business from India, 38% business from the USA, 19.95% from Europe, and 10.49% from other countries. The company has to maintain its quality so that any other player can’t intervene.

- Rising Tension between Iran and Israel: The warlike situation between Iran and Israel is a challenge for the company’s overseas business.

Conclusion

According to the company’s recent financial statement, it has a good amount of cash flow. Debt is reducing year on year. Funding is received by the company from a few investors, so with all this data, we can predict that LT Foods can be a multibagger stock. LT Foods is a small-cap company, so future growth of the company is beyond the way.

| semiconductor manufacturing companies be the next multibagger | Companies Paying Dividend this week |

| Kalyan Jewellers share price target 2024 to 2030 | REC Limited share price target 2024 to 2030 |

FAQs-

-

Is LT Foods Ltd a good buy?

LT Foods has delivered good returns consistently to its investors. The company has given 1488% returns in the last five years. LT Foods is a good buy from a long-term perspective.

-

Is LT Foods paying a dividend?

LT Foods is paying dividends to investors. Dividend yield is 0.13% of LT Foods.

-

LT Foods is profitable?.

Yes! LT Foods is a profitable company. The company’s net profit margin in FY24 is 7.69%.

-

What is the main business of LT Foods?

LT Foods has business of rice and rice-related products in India and overseas also. The company is offering good quality rice at a marginal rate.

-

Is LT Foods a multibagger?

Yes! LT Foods has given a 1514% return in the last 5 years and 6,449% all-time returns, so definitely LT Foods has proved a multibagger in history.

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not investment advice.