In this article, we will discuss about Integrated Induatries share price target 2024 to 2030 based on their financials and various reports on research analysts and brokerage firms.

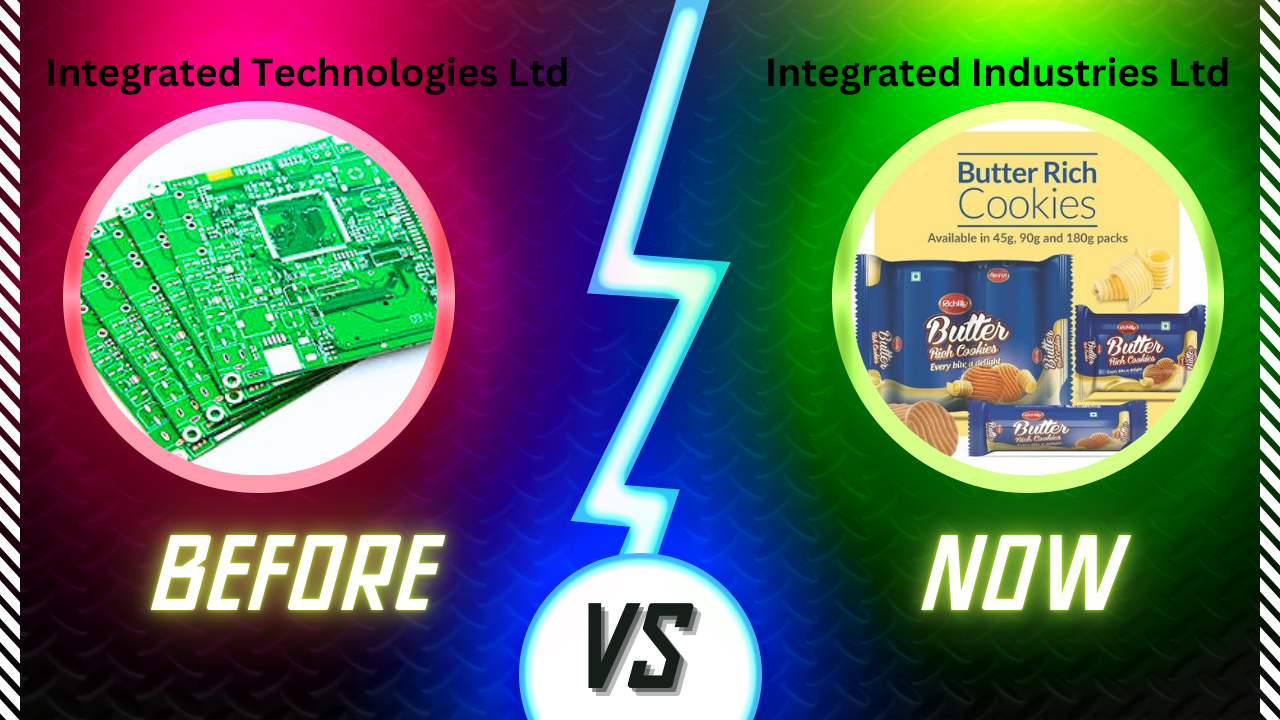

Integrated Industries Limited, formerly known as Integrated Technologies Limited, was a tech hardware company that was previously manufacturing printed circuit boards, single-sided, double-sided, and multi-layer PCBs and currently engages in manufacturing of processed food and bakery products. The company is headquartered in Gurgaon, Haryana.

| Company | MD/CEO |

|---|---|

| Integrated Industries Limited | Mr. Saurabh Goyal |

| BSE symbol | 531889 |

Company Overview

The company acquired a biscuit manufacturing plant wholly owned subsidiary of M/S Nurture Well Food Private Limited with brand names Richlite, Funtreat, and Canberra. Richlite Biscuits and Cookies are a prominent brand in North India and available in all major stores.

The company has good business in the domestic market as well as the overseas market. Integrated Industries Ltd. has the vision to be a leading and innovative biscuit manufacturing company recognized globally for its diverse product range and customer satisfaction.

If invested 1 lakh five years ago

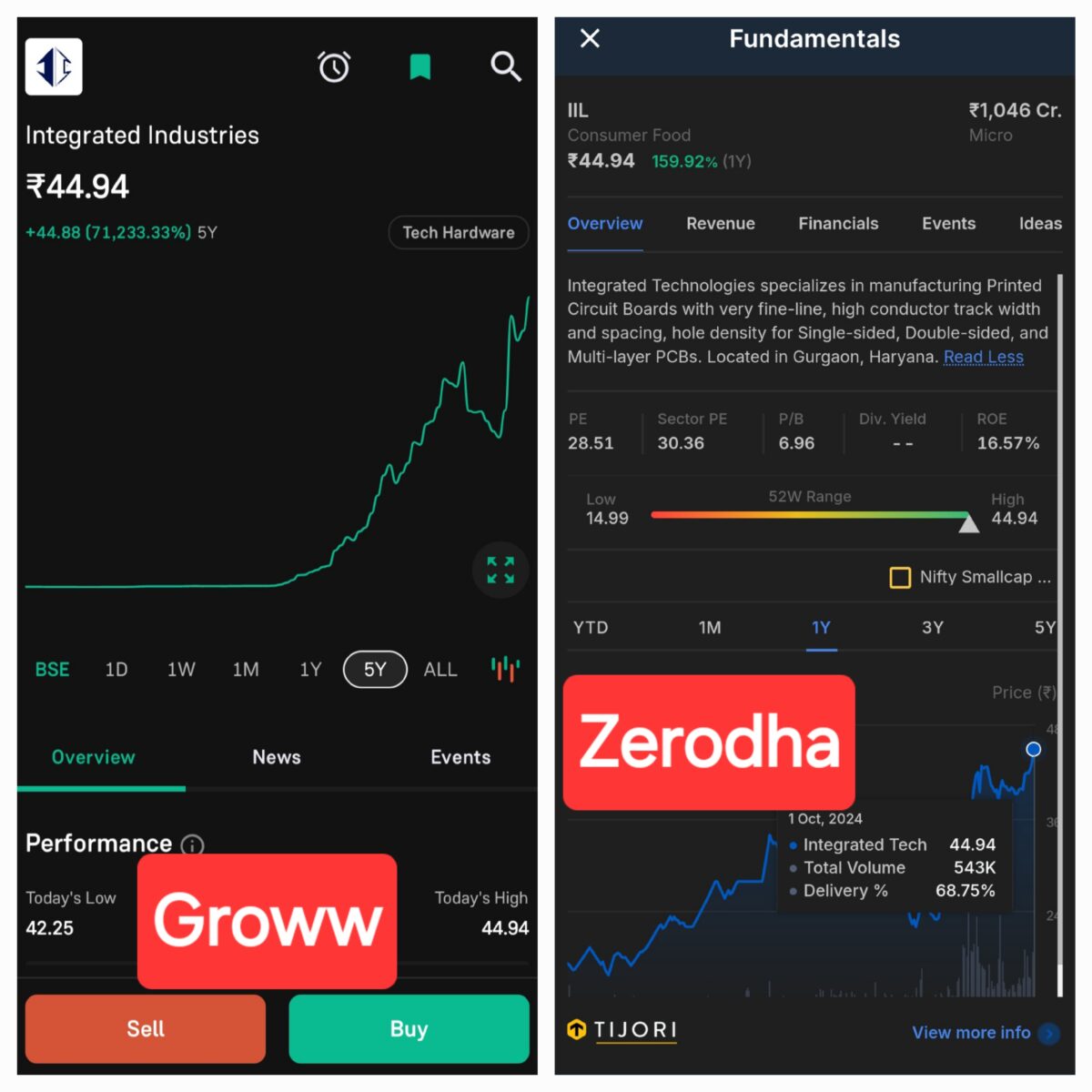

Integrated Industries was trading at just 0.69 Rs five years before, and currently, on September 27, 2024, the shares are trading at 424.05 Rs with 67.209% growth in just five years. If you have invested 1 lac Rs in this company 5 years before, then currently the value of that 1 lac Rs will become 2,92,59,450 Rs.

| Current Market Price | 44.54 |

| 5 Years Before | 0.07 |

| Growth | 71,233.33% |

| Join our WhatsApp Channel for latest updates | Stockmoodys |

| Join our Telegram Channel for latest updates | Telegram |

Fundamentals of Integrated Industries

Integrated Industries has a market cap of Rs 922 Cr with a P/E ratio of 25.11 compared to industry P/E of 56.67. This company has a return on equity of 16.57%. The share of this company has a face value of 10.

| Market Cap | 922 Cr |

| P/E Ratio | 25.11 |

| Industry P/E | 56.67 |

| Debt to Equity | 0.00 |

| Return on Equity | 16.57% |

| Dividend Yield | 0.00% |

Financials

The company has phenomenal growth of revenue from Rs 5 crore in 2023 to Rs 331 crore. The profit of the company has increased from Rs 1 crore in 2023 to Rs 25 crore in 2024.

| Year | Revenue | Profit |

|---|---|---|

| 2023 | 5 | 1 |

| 2024 | 331 | 25 |

Shareholding Pattern

The promoter of the company has reduced their stake in the company from 70.82% in June 23 to 51.56% in June 24. Retail investors have increased their stake from 28.86% in June 23 to 42.51% in the last year. Foreign institutions have also invested in integrated industries with 5.85% stake in June 24.

| Jun’24 | Mar’24 | Dec’23 | Sep’23 | Jun’23 | |

|---|---|---|---|---|---|

| Promoters | 51.56% | 52.31% | 55.90% | 56.59% | 70.82% |

| Retail | 42.51 | 41.68% | 37.11% | 36.31% | 28.86% |

| Foreign Instituion | 5.85% | 5.85% | 6.83% | 6.91% | – |

| Mutual Funds | 0.07% | 0.14% | 0.16% | 0.16% | 0.27% |

| Domestic Institutions | 0.01% | 0.03% | 0.00% | 0.03% | 0.05% |

Integrated Industries Biggest Misconception

Integrated Industries Ltd. is listed on BSE as a tech hardware company that was manufacturing the circuit boards and PCBs. After the Indian government announced subsidies for semiconductor and related products manufacturing companies, people were thinking that this company was also engaged in the manufacturing of circuit boards and PCBs, while this company has changed its mode of operation from tech hardware to processed foods (biscuits and cookies)

Stock market brokers like Zerodha and Groww are still showing their business in the tech hardware segment; that’s why people are confusing and investing in this company. The company has delivered phenomenal growth of 71,233% in stock price. After the bonus share adjustment, the stock price of this company is 44.94 Rs, and 5 years before it was just 0.07 Rs. Now you can imagine what a great return this stock has delivered.

Even promoters of this company have reduced their stake in this company from 70.82% in June 23 to 51.26% in June 24.

Conclusion

Integrated Industries Ltd. has issued a bonus share of 1:10 to its investor, which means if you have 1 share of this company, you will get 10 additional shares. After the bonus issue, the share price is Rs 44.94. If you have invested in or want to invest in this company, I hope the information given above will be helpful for you.

| semiconductor manufacturing companies be the next multibagger | कम हुआ OLA Electric का दबदबा |

| Kalyan Jewellers share price target 2024 to 2030 | REC Limited share price target 2024 to 2030 |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not investment advice.