In this article, we will discuss the Hindalco share price target for 2024 to 2035, fundamentals, future plans, and challenges depending on the various reports from research and brokerage firms and research analysts.

Quarter 2 Results

Hindalco’s financial results for the second quarter of FY25, ending September 30, 2024, showcased robust growth across key metrics:

- Net Profit: On the profit front, net profits were up a brilliant 78% yoy to Rs 3,909 crore, against Rs 2,196 crore to Q2 FY24. That is, operational efficiencies and the general market condition can be blamed for this surge.

- Revenue from Operations: Total income was up by 7% at Rs 59,278 crore, up from Rs 54,632 crore in the same period last year. This growth has been attributed to the high demand for aluminum products in so many sectors, such as the automotive industry.

- EBITDA: The consolidated EBITDA remained at Rs 9,100 crore and has increased by 49% from the previous year. This rise paves the way for the focus on cost management and optimizing the opportunity afforded by increased volumes in Hindalco.

| Financial Metric | Q2 FY 2024 | Q2 FY 2023 | % Change |

| Net Profit | 3,909 Cr | 2,196 Cr | +78% |

| Revenue from Operations | 59,278 Cr | 54,632 Cr | +7% |

| EBITDA | 9,100 Cr | 6,115.44 Cr | +49% |

Stock Performance

As of November 11, 2024, Hindalco’s stock value is about Rs 655.35 per share as compared to a 0.75% increase to the previous day’s closing. In the past year, a lot of fluctuation was observed for the scrip, which touched a low of Rs 481.1 and reached a high of Rs 772.65.

| Time | Returns |

|---|---|

| 6 month | 4.16% |

| 1 Year | 35.39% |

| 2 Year | 51.60% |

| 3 Year | 43.55% |

| 5 Year | 225.58% |

Market Sentiment

Currently, a note of optimism prevails in investor sentiment regarding the Hindalco company. However, research findings show key factors from outside that may hinder the realization of positive results in the future, such as changes in raw material prices and changes in the regulatory environment.

Industry Overview

The metals and mining industry is currently witnessing robust domestic demand driven by several key sectors:

- Construction and Infrastructure: The continuous ongoing infrastructure projects in India are leading to the need for aluminum products that are used in construction materials.

- Electricals and Electronics: Another factor contributing to rising demand for aluminum is the fact that aluminum is being used mainly in electrical applications due to its lightweight and conductivity features.

- Competition for Raw Materials: The fluctuating policies that surround the importation of aluminum scrap from China have given the industry a different tendency to compete with the local scrap sources in pricing.

- Global Economic Conditions: The world metal prices remain a volatile factor due to recurrent tensions in world politics and regional or global recession, which influences the profit margins of a firm such as Hindalco.

Company Overview

Hindalco operates through two primary segments:

- Aluminium: The metal segment involves primary aluminum and fabricated metal products, which include aluminum rolled products, aluminum extrusions, and aluminum foils. The Hindalco company has established itself as the sixth largest producing company that deals in aluminum in India.

- Copper: The copper cluster consists of operations for producing copper cathodes and different copper products used in electronics.

The company has displayed a good supply chain and distribution model that facilitates it to cover many requirements of the various customers it serves.

Financials

The company’s total revenue, coupled with Rs 559,940 million, is an upsurge of 6.06% from Rs 528,080 million recorded in the same quarter in FY 2023. This growth in revenue was due to its sales increases in its aluminum and copper products.

Looking at the various operational parameters, the firm recorded an operating income of Rs 48,210 million, an increase of 15.00% in comparison to Rs 41,680 million in the previous year. This increase points to efficiency in cost control and operational-enhancing activities.

Its net income was Rs 30,740 million, making it a stellar 25.20% higher than Rs 24,540 million in Q4 FY 2023. This enormous increase in net income strongly supports Hindalco’s healthy profitability and good strategic management.

| Financial Metric | FY 2024 (Q4) | FY 2023 (Q4) | % Change |

| Total Revenue | Rs 559,940 million | Rs 528,080 million | +6.06% |

| Gross Profit | Rs 179,910 million | Rs 171,010 million | +5.23% |

| Operating Income | Rs 48,210 million | Rs 41,680 million | +15.00% |

| Net Income | Rs 30,740 million | Rs 24,540 million | +25.20% |

| Basic Earnings Per Share (EPS) | Rs 14.29 | Rs 10.85 | +31.56% |

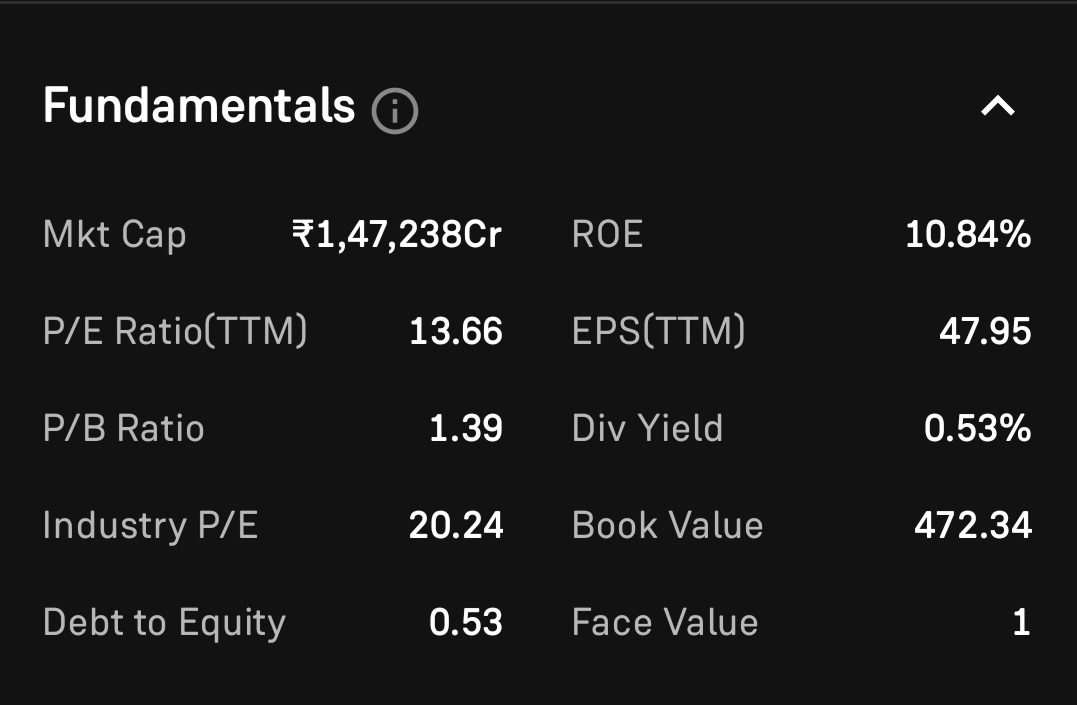

Key Financial Ratios

| Financial Ratio | Value |

| Gross Margin TTM | 31.32% |

| Operating Margin TTM | 8.37% |

| Net Profit Margin TTM | 4.67% |

| Return on Investment TTM | 7.14% |

Hindalco Share Price target for next 10 years

| Year | Minimum share price | Maximum share price |

|---|---|---|

| 2024 | 460 | 750 |

| 2025 | 520 | 821 |

| 2026 | 658 | 1050 |

| 2027 | 760 | 1240 |

| 2028 | 880 | 1445 |

| 2029 | 1040 | 1650 |

| 2030 | 1200 | 1850 |

| 2031 | 1354 | 2046 |

| 2032 | 1574 | 2284 |

| 2033 | 1865 | 2650 |

| 2034 | 2205 | 3050 |

| 2035 | 2856 | 3557 |

Hindalco share price target for 2025

The share price of Hindalco is expected to witness a bullish trend in the year 2025, with the maximum share price Rs 821 in FY25. The growth percentage for Hindalco shares is predicted to be positive, with an upward trend towards the end of the year.

Hindalco share price target for 2030

The share price of Hindalco is expected to witness a bearish trend in the year 2030, with the maximum share price Rs 1,850 in FY 2030 and the minimum share price Rs 1,200 in FY 2030.

Based on current data, the share price target of Hindalco in 2030 is positive, and the stock has potential to grow. This should be a good investment recommendation for long-term investors.

Hindalco share price target for 2035

The share price of Hindalco is expected to witness a bullish trend in the year 2035, with the maximum share price Rs 3,557 in FY 2035 and the minimum share price Rs 2,856 in FY 2035.

Based on current data, the share price target of Hindalco in 2035 is positive, and the stock has potential to grow. This should be a good investment recommendation for long-term investors.

Strengths

- Strong Revenue Growth: The general upward trend for the past several quarters attests to solid demand for its offerings.

- Operational Efficiency: Today, it has proved possible for the company to manage cost control, hence boosting its margins irrespective of associated raw materials’ varying prices.

- Diverse Product Portfolio: Hindalco has product diversity and thus minimizes risk factors that are associated with dependency on one particular product or market.

Weaknesses

Despite its strengths, Hindalco faces particular challenges:

- Debt Levels: However, it is expressed that it is almost free from debts, as the figure of 89% depicts that it’s a blend of debt and equity financing. High levels of debt are dangerous in cases of operating risks, recession, or when business returns are low.

- Market Volatility: As raw materials, the price of products in the metals industry varies due to differences in international production, supply and demand, thereby making it hard to predict profit levels accurately.

Future Plans

- Expansion Projects: They seek to spend between $4 billion and $5 billion within the next three years on increasing the upstream business of both its aluminum and copper divisions. These are new smelters and alumina refineries that will strengthen the production capability.

- Sustainability Initiatives: Currently, Hindalco is shifting more and more toward sustainability through capital expenditure on clean technologies to minimize the carbon footprint of aluminum production. This goes in tandem with current developments across the world of doing away with equally polluting ways of production.

- Innovation and R&D: In an effort to increase product growth, the company will advance its current research with the objective of establishing new products that fit the developing market needs and improving overall organizational productivity.

Conclusion

Among the players in the metals sector, Hindalco Industries seems to be relatively immune to the crisis test, having impressive financial performance in crisis time. Such investments were made with a focus on extending production capacities as well as improving operation productivity, which put it in a vantage position for future operations. But one should not get carried away since such a return comes with high risks tied to its high debt level and the market’s unpredictable volatility that influences profit-making.

In conclusion, it is expected that companies like Hindalco will have a bright future, and based on these various areas of evaluation, investing in Hindalco will be a good investment game since it has almost every positive factor, which is vital in every excellent investment game.

| Hind rectifiers share price target 2024 to 2035 | Read More… |

| Zen Technologies share price target 2024 to 2035 | Read More… |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not an investment advice.

FAQs

Should I invest in Hindalco or not?

Overall, analysts suggest that Hindalco stock should be a buy, given its good financial results as well as prospects in the metal industry. Nevertheless, one should consider his/her/its ability to face losses concerning the volatility indices of the financial market.

Is Hindalco a multibagger?

Currently, Hindalco has proved itself to be an odds-on favorite in terms of growth as time shifts. But whether it can transform into a multi-bagger is more about drawing improved performances and, of course, the right market conditions.

Who is the owner of Hindalco?

Hindalco operates under the Aditya Birla Group company, and its chairman is Kumar Mangalam Birla.

Is Hindalco debt-free?

However, it should be noted that Hindalco does have some debt, as according to the percentage showing, it has about 89% of debt; however, that is not very high compared to its equity base.

What are the products of Hindalco?

Hindalco offers and majorly deals in aluminum products like sheets, foils, extrusions, copper products like cathodes, and various copper alloys used in multiple sectors such as construction, electrical, packing, automobiles, etc.