In this article, we will discuss the Avalon Technologies share price target for 2024 to 2035, fundamentals, future plans, and challenges depending on the various reports from research and brokerage firms and research analysts.

Quarter 2 Results

An excellent performance of Avalon Technologies is demonstrated in the second quarter of the fiscal year 2025.

- Net profit stood at Rs 17.48 crore, known to be 140% higher than the same period from last year.

- The company has achieved an equally phenomenal increase in revenues from operations, which has gone up 36.8% to Rs 275.02 crore.

- There was also EBITDA growth to Rs 30.34 crore from the prior year Rs 14.33 crore for the company.

- The EBITDA margin for the period was 11.3%, an improvement from 6.3 percent in the same period last year due to increased operational efficiency.

Industry Overview

Avalon Technologies’ sphere of operation includes the electronics manufacturing services (EMS) industry, which is very much cutthroat. The EMS industry is composed of companies that design, manufacture, assemble, test products, distribute parts and electronics components, and provide return/repair services.

The technological advancement in the industry is fast, and this puts pressure on firms to come up with new ways of doing things. The EMS market at the global level is expected to show a higher growth rate in the near future because of the higher demand for sophisticated electronics in different fields like consumer electronics, automobiles, medicine, and industrial control. This growth creates the prospect and risks for organizations such as Avalon Technologies through changes in customer expectations, supply chain, and competition pressures.

Company Overview

Initially created with the goal of offering integrated manufacturing services, Avalon Technologies has become an essential constituent of the EMS sector. Services that the firm provides include product design, product development to manufacture, small-scale production, large-scale production services, and other value-added services. All the manufacturing facilities of Avalon have seamless, integrated manufacturing capabilities that provide the right technological environment for manufacturing high-precision engineering goods.

The company’s proficiency is in different areas, namely printed circuit boards (PCBs), electronic systems, and high-value specialized engineering merchandise. Avalon Technologies has in its list of clients convenience stores and industrial manufacturers, mobility, clean energy, and healthcare industries.

Through existing and long-standing supplier relationships backed by the organization’s certified quality systems, the organization can reliably provide quality products for its clients. High-value precision engineering products define Avalon’s strategic positioning away from its rivals by enabling the company to secure good market share in its specialized sectors.

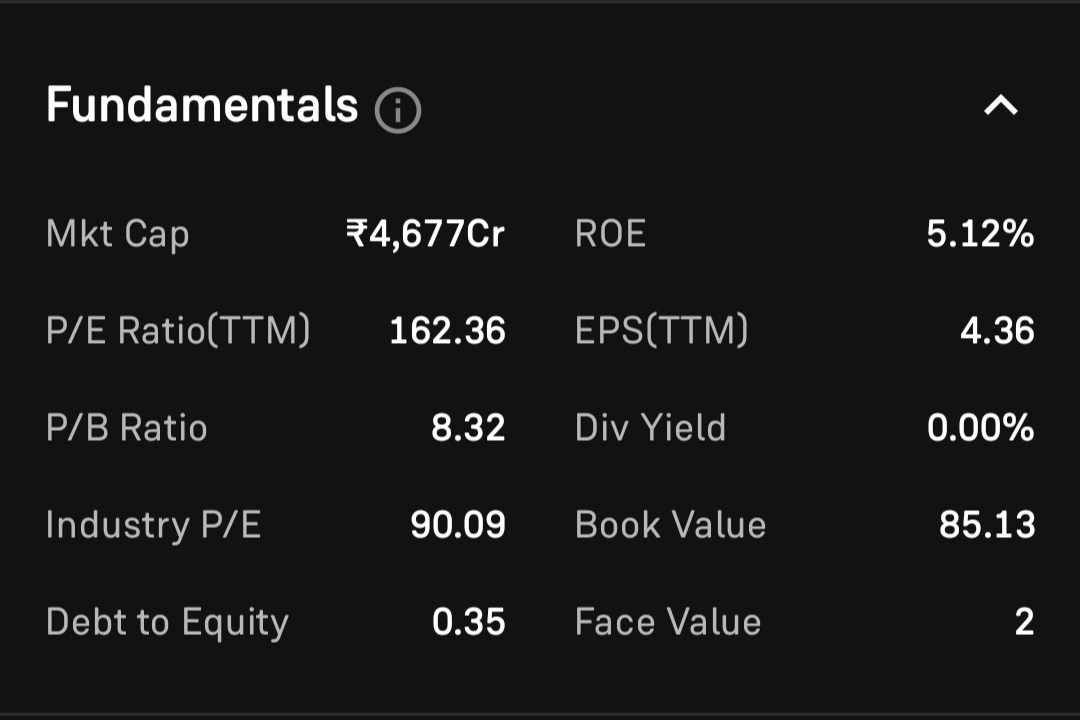

Financials of Avalon Technologies

Market capitalization: Rs 4,590.85 crore

Revenue (Q2FY25): Rs 275.02 crore

Net Profit (Q2FY25): Rs 17.48 crore

EBITDA (Q2FY25): Rs 30.34 crore

Price to Earnings (P/E) Ratio: 134.87

Earnings per Share (EPS): Rs 4.37

Avalon Technologies share price target for 2024

Avalon technologies share price target for 2024 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price Rs 920 and lowest share price target Rs 420 in FY 2024.

| 2024 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 420 | 880 |

| 2nd Price Target | 450 | 920 |

Avalon Technologies share price target for 2025

Avalon technologies share price target for 2025 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 750 and lowest share price target Rs 1,310 in FY 2025.

| 2025 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 750 | 1255 |

| 2nd Price Target | 785 | 1310 |

Avalon Technologies share price target for 2026

Avalon technologies share price target for 2026 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 1,080 in and lowest share price target Rs 1,820 FY 2026.

| 2026 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 1080 | 1635 |

| 2nd Price Target | 1130 | 1820 |

Avalon Technologies share price target for 2030

Avalon technologies share price target for 2030 is in Consolidation range due to election, according to research analysts and brokerage firms, it may touch highest share price target Rs 2,540 in and lowest share price target Rs 3,350 FY 2030.

| 2030 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 2540 | 3274 |

| 2nd Price Target | 2610 | 3350 |

Avalon Technologies share price target for 2035

Avalon technologies share price target for 2035 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 4,110 and lowest share price target Rs 2,850 in FY 2035.

| 2035 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 2850 | 3845 |

| 2nd Price Target | 3010 | 4110 |

Strengths of Avalon Technologies

Strong Financial Performance: Analyzing Avalon Technologies, the company’s experience is characterized by very high sales increases and constant growth of net income.

Diversified Product Portfolio: Diversification of the company’s product portfolio is a strength of the company since it means that it is not over-reliant on any particular sector.

Global Presence: In this context, Avalon Technologies is well established in domestic as well as international markets, especially the USA, which helps its growth.

Skilled Workforce and Advanced Facilities: The sophisticated plant installations and the well-trained human capital make it possible for the company to manufacture quality products at low costs.

Strong Order Book: Avalon also enjoys a healthy backlog, proving market demand in its order books; hence, securing future revenues is almost inevitable.

| Join our WhatsApp Channel for latest updates | Stockmoodys |

Weaknesses of Avalon Technologies

High Valuation: Otherwise, such a figure suggests that the company’s stock is overpriced relative to earnings, information that may make some investors reluctant to invest.

Profitability Fluctuations: Avalon has had negative profits in some of its quarters, which generates doubts about the future results of the company.

Decreasing Promoter Shareholding: The first one is that a reduction of the level of promoter shareholding could be construed negatively by investors in that it looks like an indication of a lack of confidence amongst lovers of the company’s stocks in the future fortunes of the company.

Dependence on Key Customers: The critical problem in Avalon Technologies is that the company has a high reliance on a few customers, and they receive a large percentage of the company’s revenue from these few sources. The dependence can be a threat if any of these customers decide to order less or change their supplier.

Exposure to Market Volatility: This means that it will remain vulnerable to other factors like demand status, supply chain stresses, and the cyclical economic status of the international market, which has a direct influence on the company’s revenue and profitability.

Conclusion

Overall, it can be concluded that Avalon Technologies has good financial performance, and the company started to show good growth prospects, which makes this stock an exciting investment instrument. The current market structure of the company and the forecast of future growth are very optimistic for the following reasons: It has diversified products. It has a global presence. Its current and future expansion strategies are very effective.

However, investors are advised to bear in mind the fact that the program carries a high valuation, and profitability may fluctuate at times. In total, Avalon Technologies can be considered a stock to keep an eye on concerning the EMS position.

| Piramal Pharma share price target 2024 to 2030 | Read More… |

| Kwality Pharma share price target 2024 to 2030 | Read More… |

FAQs

Is Avalon Technologies an excellent stock to buy?

This depends on your investment objectives and, indeed, your level of tolerance towards risks. This company has had solid growth and possesses sound, profitable expansion plans for the future, but it does have a relatively high P/E ratio that may signify that the firm is overpriced.

Is Avalon Technologies a multi-bagger?

Thanks to high efficiency and experience in acquisitions, Avalon Technologies can turn into a multiple-high flyer.

Who is the owner of Avalon Technologies?

The promoters thus control a 50.70 percent share of the company.

Is Avalon Technologies debt-free?

It is noteworthy that there is no significant amount of debt on the company’s balance, which proves that it has a solid financial position.

What is the product of Avalon Technologies?

Since the company will be operating in the electronics manufacturing solutions industry, Avalon will be offering the following mainstream solutions: printed circuit boards, electronic systems, and high-value precision engineering products.