In this article, we will discuss the CNI Research share price target for 2024 to 2035, fundamentals, future plans, and challenges depending on the various reports from research and brokerage firms and research analysts.

CNI Research Ltd. serves to be a leading research institution operating in the financial services industry in India. The company was founded in 1982 and provides equity research services and advisory, along with creating content for domestic and overseas investors. CNI Research has managed to establish a unique business by quantitative analysis and qualitative research approaches, proposition to enable clients to make the right investment decisions.

Quarter 2 Results

In its recently released quarter 2 results for the quarter ending September 2024:

Net Sales/Income from Operations: Rs 0.33 crore

Total Income from Operations: Rs 0.33 crore

Expenditure:

- Purchase of traded goods: Rs 0.29 crore

- Other Expenses: Rs 2.97 crore

Profit/Loss Before Tax: Rs -2.99 crore

Net profit/loss for the period: Rs -3.16 crore

Basic Earnings Per Share (EPS): Rs 0.28

Stock Performance

CNI Research’s stock performance has been noteworthy:

Current Price: At the moment, the stock is closer to Rs 14.76, and thus, any good fundamental news should be able to have a positive impact on the price.

Market Capitalization: It has a market capitalization of about Rs 171 crore.

52-Week Range: The stock has also been very volatile over the year, ranging from an all-time low of₹2.05 to an all-time high of Rs 15.44.

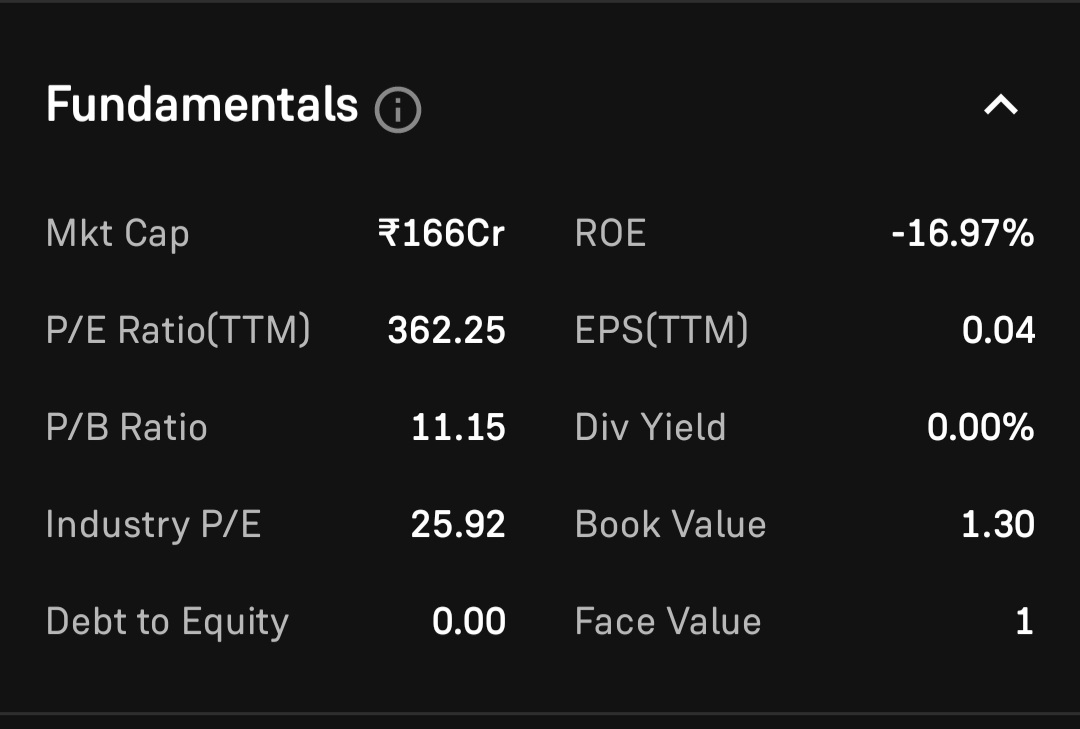

Valuation Ratios:

P/E Ratio: About 372.50, indicating that the stock is perhaps overpriced with regards to the earnings ratio.

P/B ratio: 11.46, meaning that the market strongly expects the mobility vision to grow in the future.

Dividend Yield: This is currently at 0%, proving the company follows a policy of reinvestment as opposed to reaping profits from the company’s earnings for shareholders.

Industry Overview

CNI Research, in fact, belongs to the global financial services sector, and as such, it is experiencing global trends that involve the rapid advancement in technology and the gradual rise in the populace’s financial competence in India.

Market Dynamics

Consequently, the industry remains undemerged in India, and only 7% of the people invest in mutual funds. This is an advantage because it offers a lot of growth prospects for other companies, such as CNI Research, that deal with research and advisories. Besides, in the wake of growing globalization and increasing numbers of clients looking for professional advice on how to invest in diversified risky securities, there will be an increased need for high-quality research.

Competitive Landscape

Financial services is a highly saturated industry where one can find large and well-developed companies alongside relatively fresh fintech companies. CNI Research stands out from competitors with the focus on qualitative research and individual approaches to clients.

Financials

Yearly Performance Overview

CNI Research’s annual performance has shown fluctuations:

March 2024:

- Net Sales: Rs 2.78 crore (up 197.85% year-over-year)

December 2023:

- Net Sales: Rs 1.86 crore (down 38.73% year-over-year)

September 2023:

- Net Sales: Rs 2.56 crore (down 24.75% year-over-year)

Key financial metrics

Profitability Ratios

- Net Profit Margin: The net profit margin has occasioned considerable fluctuation, and the most recent quarters, in particular, are harmful due to the expense rise.

- Growth Metrics: Compounded Annual Growth Rate (CAGR): Despite the observed problems, the company has established high growth rates of profits, with a CAGR of approximately 30.68% for the past three years.

CNI Research share price target for 2024

CNI Research share price target for 2024 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 21 and lowest price target Rs 2 in FY 2024.

| 2024 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 2 | 18 |

| 2nd Price Target | 5 | 21 |

CNI Research share price target for 2025

CNI Research share price target for 2025 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 35 and lowest price target Rs 8 in FY 2025.

| 2025 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 8 | 30 |

| 2nd Price Target | 12 | 35 |

CNI Research share price target for 2026

CNI Research share price target for 2026 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 45 and lowest price target 25 in FY 2026.

| 2026 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 25 | 40 |

| 2nd Price Target | 28 | 45 |

CNI Research share price target for 2030

CNI Research share price target for 2030 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 130 and lowest price target Rs 80 in FY 2030.

| 2030 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 80 | 120 |

| 2nd Price Target | 85 | 130 |

CNI Research share price target for 2035

CNI Research share price target for 2035 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 105 and lowest price target Rs 260 in FY 2035.

| 2035 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 105 | 255 |

| 2nd Price Target | 110 | 260 |

| Liquor company jumps up 13% after announcing Q2 result | Read More… |

Strengths

- Debt-Free Status: The company is also accessible from debt, which is a significant advantage of CNI Research as a business. On the same note, this kind of financial position makes the company uncharged by interest charges and offers more space for future undertakings.

- Strong Revenue Growth: The high increase in its revenues over the year also confirms efficient management and demand for the services provided.

- Experienced Leadership: The management of this company comprises well-experienced finance and investment research personnel.

Weaknesses

- High Valuation Ratios: The observed P/E ratio of approximately 372.50 seems to be overpriced in comparison with the earnings possibility. Investors should be cautious since, with a high valuation, a firm can be dragged down in the event that it is unable to meet set growth prospects.

- Low Promoter Holding: Promoter holding remains very low at 37.1%. This relatively low stake can, however, cause investors to doubt the management’s confidence in the future of the company.

- Low Return on Equity (ROE): It is also possible to notice inefficiencies in generating profits from the standpoint of shareholders’ equity using the industry ROE of approximately 6.85 percent.

Future Plans

CNI Research is focused on several strategic initiatives aimed at enhancing its market position:

- Expansion of Services: This firm wants to expand from equity research to providing better investment solutions to investors of different classes.

- Technology Integration: This will be important as the insurance industry moves to adopt newer technologies and embrace more significant use of data analytics to drive enhanced organizational effectiveness and to provide clients with even better value.

- Market Penetration: Therefore, as awareness and financial knowledge of the Indian population grows, CNI Research ought to cover a more significant portion of the expanding pool of investors and increase its communication and advertising.

- Partnerships and Collaborations: A possible advice fell on cooperation with other financial institutions since it would allow extending the range of services offered and creating collaboration with potentially new clients.

Conclusion

From the above financial analysis, CNI Research exhibits an attractive investment profile in terms of high revenue growth and a debt-free balance sheet, but caution should be taken due to the high valuation basis and low promoter share. As the company plans and actually builds more services to offer and utilizes technology for growth, it could be a big player in the future of the financial services industry in India.

However, there are some positive signs in the outlook for future expansion, and we have mainly recommended that potential investors approach their investments with their eyes open.

| Hind rectifiers share price target 2024 to 2035 | Read More… |

| Sagarsoft share price target 2024 to 2035 | Read More… |

FAQs

Should I purchase the shares of CNI Research?

With CNI Research being a relatively young company, it has demonstrated consistent historical growth; however, having a P/E ratio of more than 50, the company may be overpriced in terms of its earnings prospects.

Is CNI Research a multi-bagger?

Analyses have shown that the company exhibits behavior similar to a multi-bagger in other fiscal years, but the current position calls for questions.

Who is the owner of CNI Research?

Kishor Ostwal is the managing director of the company, while Sangita Ostwal is an independent director.

Is CNI Research debt-free?

Indeed, CNI Research has limited amounts of debt on its balance sheet, which makes the company financially secure.

What categories of products does CNI Research provide?

CNI Research focuses on equity research and advisory services in report contents and investments covering domestic and international investors.

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not investment advice.