In this article, we will discuss the Gland Pharma share price target for 2024 to 2035, fundamentals, future plans, and challenges depending on the various reports from research and brokerage firms and research analysts.

Quarter 2 Results

The net profit of Gland Pharma in the second quarter of fiscal year 2024 decreased remarkably 15.7% year-on-year. The net profit for this period is Rs 163.5 crore, a much higher number than the Rs 144 crore for the quarter ending on 30 June 2024.

- Net sales for Quarter 2 were reported at Rs 1,465 crore compared to Rs 1,453 crore in Quarter 1 sales rise by 2.36% QoQ.

- Net profit increased in Quarter 2 to Rs 164 crore compared to Rs 144 crore in Quarter 1.

- Gland Pharma reported Rs 49.3 crore for R&D expenses, 4.6% of its revenue.

- The company recently launched molecules: cetrorelix acetate, ephedrine sulfate, tranexamic acid, and diazepam.

CEO and Executive Chairman of Glan Pharma, Mr. Srinivas Sadu, said, “Our overall performance is in line with expectations.”

Quarter 2 results of Gland Pharma came after the close of the market hours. The share price of the company is down by -2.15% today to Rs 1,610.

Industry Overview

The company is situated in the pharmaceutical sector, namely injectable products. The global market of pharmaceuticals is defined by high growth rates arising from the ever-growing demand for medicines, the continually growing average age of the population, and constant improvements in medical technology. The injectable segment is expected to grow more due to an increase in the number of biologic drugs and complex generic drugs.

The industry is thus saturated with many firms that compete for market share in the industry. Key trends influencing the market include:

Regulatory Changes: New rules are defining the products more tightly and refining the evaluation of products.

Technological Advancements: New methods of medication administration and production technologies are critical.

Globalization: Market development is discussed as an essential area that opens some opportunities and poses threats to the development of firms in emerging economies.

Therefore, there is always immense pressure on Gland Pharma and other firms to create new and successful business models.

Company Overview

Gland Pharma was established in 1978 in Hyderabad, India, and has grown from a contract manufacturing firm to an essential company for the production of basic human generic injectables. It is a business-to-business organization that provides its products to more than 60 countries, with the major markets in the USA and Europe.

Further, Gland Pharma’s newly developing strategic affiliation with Shanghai Fosun Pharmaceutical has added to its strength. This relationship improves its research and development (R&D) and gets international markets for its growth opportunities.

Product Portfolio

The Company Gland Pharma focuses on the portfolio business of injectable products for multiple therapeutic segments, including oncology, anesthetics, anti-infectives, and others. This compliance with high-standard regulatory requirements is an indication of the quality adopted by the company across different jurisdictions.

Financials of Gland Pharma

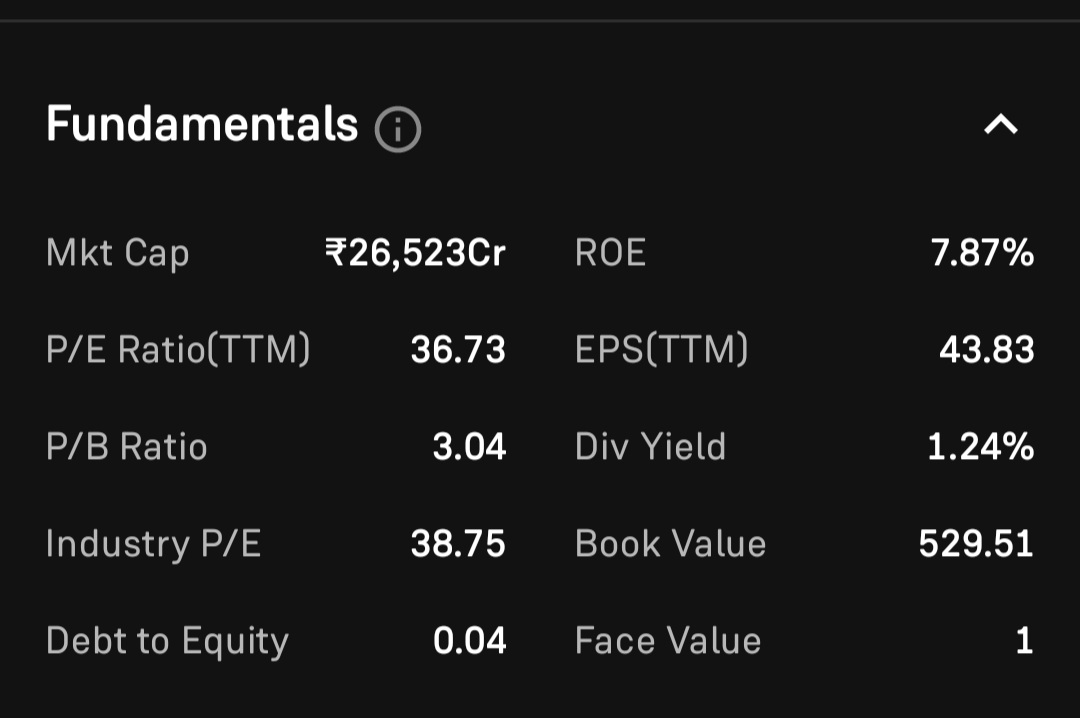

Key financial metrics

Market capitalization: Rs 26,523 crore

Current Share Price: Rs 1,610

52-Week Range: The 52-week high was Rs 2,220.95, and the 52-week low was Rs 1,486.65.

Price-to-Earnings (P/E) Ratio: 36.73

Dividend Yield: 1.24%

Return on Capital Employed (ROCE): 13.6%

Return on Equity (ROE): 7.87%

All these financial ratios give information on the financial strength and position of Gland Pharma. Looking at the P/E ratio on the chart, it is observed that this share might be overpriced in relation to its earnings capacity; nevertheless, this can also be explained by the high expectations for future earnings growth.

Gland Pharma share price target for 2024

Face value of Gland Pharma share is Rs 1.00.

| 2024 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 1450 | 2350 |

| 2nd Price Target | 1510 | 2420 |

Gland Pharma share price target for 2025

| 2025 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 2050 | 3205 |

| 2nd Price Target | 2130 | 3310 |

Gland Pharma share price target for 2026

| 2026 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 2850 | 3880 |

| 2nd Price Target | 3020 | 3915 |

Gland Pharma share price target for 2030

| 2030 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 5,475 | 6,205 |

| 2nd Price Target | 5,585 | 6,285 |

Gland Pharma share price target for 2035

| 2035 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 8,483 | 9,204 |

| 2nd Price Target | 8,550 | 9,455 |

Recent Performance Analysis

The revenues of this company have been on the rise. Nevertheless, measures of profitability like ROCE and ROE should be considered. The company needs to find ways to improve efficiency further, as the return on capital employed stands at 13.6%.

This is even when shareholders’ equity has a low turnover in generating profits, as evidenced by the relatively low ROE of 9.26%. These numbers should be watched closely because they have an impact on the long term, especially where long-term investment is being contemplated.

Strengths of Gland Pharma

Strong Market Position: Gland Pharma is one of the major players in the Indian market of injectable products and has a good image at the national and international levels.

Robust R&D capabilities: To develop compound generics that address new health needs, the firm spends a lot of money on research and development.

Debt-Free Status: Having low debt levels also makes Gland Pharma financially strong, especially with regard to investment in capital that enables it to reap high returns without being slowed down by high interest to pay.

Diverse Product Portfolio: The broad portfolio in terms of therapeutic segments puts Gland Pharma against several competitors.

Global Reach: This also has mitigated vulnerability through the attainment of a robust localization from over 60 countries.

| Join our WhatsApp Channel for latest updates | Stockmoodys |

Weaknesses of Gland Pharma

Low ROE: A ROE of approximately 9.26% shows that the organization may not be maximizing shareholders’ equity correctly.

Dividend Payout Concerns: Especially for the investors seeking regular incomes, here they have a company with a relatively low dividend payout ratio, which was 14.2% during the last three years.

Decreasing Promoter Holding: When there is a decrease in the promoter holding to about 6.19%, it is a worry to the extent that insiders have confidence in the prospects of the company.

Operational Challenges: The signs, more so the slight decline in the operating profit margin, hint at troubles in controlling the operations expenses.

Regulatory Risks: Like any firm in the pharmaceutical value chain, Gland Pharma exposes itself to regulatory compliance risks that affect its product approval and entry into the market.

Future Plans of Gland Pharma

Expanding Product Lines: There is a prospect for new formulations and complex generics to meet the increasing market demand in the international arena.

Geographic Expansion: Its strategies also include expanding coverage in semi-regulated markets but, at the same time, consolidating in mature markets like the USA and Europe.

Partnerships for Growth: To strengthen its market position, it will seek partnerships for product development and licensing with better market access.

Sustainability Initiatives: Adherence to the concepts of environmental management will not only conform to legal requirements but will also be appreciated by socially responsible consumers.

This is with the view to make Gland Pharma a market leader in the global injectable market without compromising on the longevity of the business.

Conclusion

Suppose one is looking for a company that would attract investment in this industry. In that case, Gland Pharma has all the makings of an exciting investment proposition, as it has strategic positioning, a promising pipeline of products, and a focus on research and development. But their potential investors should approach it with so much caution since its return on equity and dividend payout are some of the main factors that could influence long-term returns.

With the advancement in the technological framework as well as in the regulatory framework, Gland Pharma’s aptitude to do so will play a significant role in its success span.

| Piramal Pharma share price target 2024 to 2030 | Read More… |

| Kwality Pharma share price target 2024 to 2030 | Read More… |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not investment advice.

FAQs

Is Gland Pharma Industries a good investment stock?

To that extent, the sharp features of Gland Pharma’s balance sheet are revealing and must be aligned with the rationality of their generic financial investment plans.

Is Gland Pharma a multibagger?

This could present future growth, but past performance is no indicator of the future, and as such, research has to be done.

Who is the owner of Gland Pharma?

Daimler mainly owns a 5% stake, with the Shanghai Fosun Pharmaceutical Group as the majority owner.

Is Gland Pharma debt-free?

Indeed, Gland Pharma operates with less than optimal amounts of debt.

What type of products does Gland Pharma manufacture?

It deals with injectables in different therapeutic product segments, for instance, oncology, anesthetic, anti-infective, and others.