In this article, we will discuss the Kothari petrochemicals share price target for 2024 to 2035, fundamentals, future plans, and challenges depending on the various reports from research and brokerage firms and research analysts.

Quarter 2 Results

For the second quarter of FY 2024, the total income of Kothari Petrochemicals increased to Rs 184 crores, from the first quarter of FY 2024 when the income was reported to be Rs 149 crore. The total expenses of the company, too, increased to Rs 162 crores. Yet, Kothari Petrochemicals reported Rs 16 crore of net profit less than compared to the same period of the previous year. The operating margin is received at 13.48%, while the net profit margin was 9.04%. These figures show that though the company’s revenues are lower, the company has been able to earn profits through efficient control of its expenditures.

| Sep’24 (Cr) | YoY Change | QoQ Change | |

|---|---|---|---|

| Sales | 180 | 11.79% | 24.66% |

| Operating Profit | 20.57 | -25.06% | 11.15% |

| Net Profit | 16.33 | -11.92% | -15.66% |

Industry Overview

Growing Demand: The popularity of petrochemical products because of the growth of industries and expanding urban areas.

Technological Advancements: Technological and organizational improvements within manufacturing and its products are increasing productivity whilst decreasing adverse environmental effects.

Regulatory Environment: Tackling of environmental issues is forcing organizations to adopt sweat policies and practices so that they can meet the standards.

The petrochemical industry is relatively saturated and fiercely contested as many original rivals exist, as well as new market entrants. We also learn that for organizations to sustain growth, they have to evolve to the ever-changing market forces constantly.

Company Overview

Founded in the year 1990, KPL is a micro cap pioneer company in the manufacturing of PolyIso Butylene (PIB), which has applications in areas such as adhesives, sealants and lubricants. The company has succeeded in expanding its coverage in both domestic and foreign markets significantly.

Product Portfolio

PIB is the main product of Kothari Petrochemicals Limited It has high efficiency and practically can be helpful in many different ways. The execution of this policy has enabled the company to continue to create a competitive advantage in the petrochemical business.

Financial of Kothari Petrochemicals

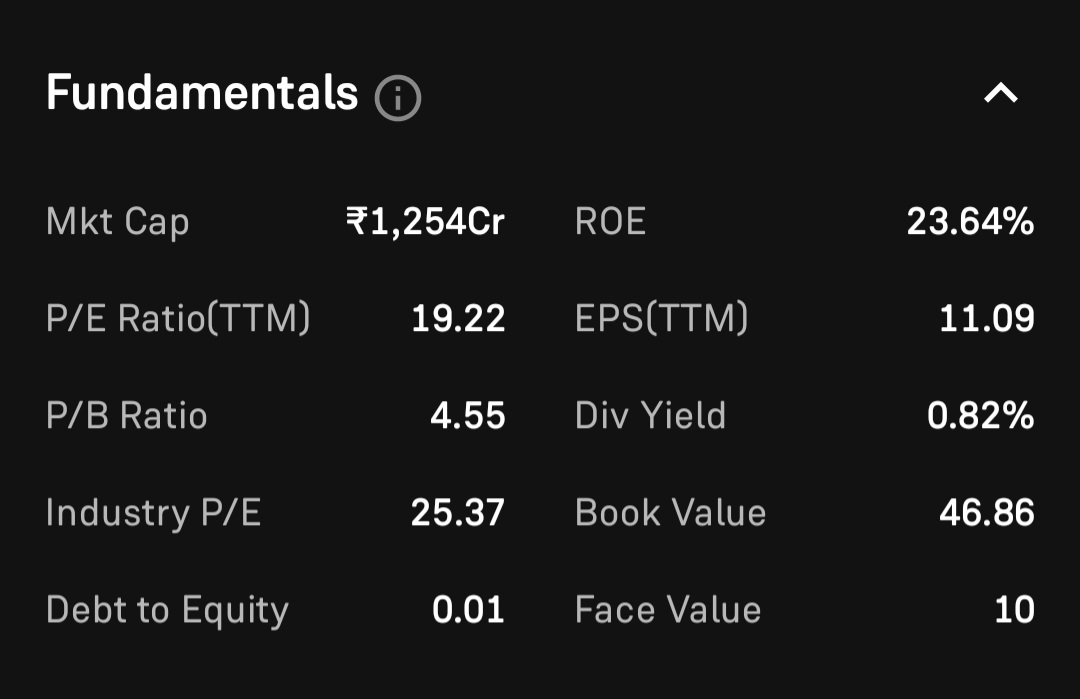

Key Financial Metrics

Market Capitalization: Rs 1,254 crore

Current Share Price: Rs 214

52-Week Range: High of Rs 267 and low of Rs 108

Price-to-Earnings (P/E) Ratio: 19.21

Book Value: Rs 41.9

Dividend Yield: 0.82%

Return on Capital Employed (ROCE): 41.3%

Return on Equity (ROE): 25.68%

These figures are all indicators of muscular financial strength and the market position of Kothari Petrochemicals in the petrochemical sector.

Stock Performance Analysis

Total income for the financial year FY2024 thereof was Rs 611.36 crores; this increased by 25.13% from the FY2023 total income of Rs 488.58 crore. The amount of profit after tax for FY2024 was Rs 63.78 crore, a phenomenal growth rate of 62.81%. The following figures illustrate this consistent upward movement of revenues and earnings as signs of sound business strategies exercised at Kothari Petrochemicals.

Kothari petrochemicals share price target for 2024

Kothari Petrochemicals has delivered 64% returns in last one year to its investors and 1,155% multibagger returns in last five years.

| 2024 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 165 | 240 |

| 2nd Price Target | 174 | 255 |

Kothari Petrochemicals share price target for 2024 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price Rs 255 in FY 2024.

Kothari petrochemicals share price target for 2025

Foreign Investors has increased their stake with 0.32% in recent quarter result.

| 2025 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 220 | 350 |

| 2nd Price Target | 245 | 366 |

Kothari Petrochemicals share price target for 2025 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price Rs 366 in FY 2025.

Kothari petrochemicals share price target for 2026

The company generates its total revenue from Poly Iso Butylene (PIB) products. 68.49% revenue comes from India and rest 31.51% from International market

| 2026 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 335 | 480 |

| 2nd Price Target | 350 | 505 |

Kothari Petrochemicals share price target for 2026 may be in consolidated trend according to research analysts and brokerage firms, it may touch highest share price Rs 505 in FY 2026.

Kothari petrochemicals share price target for 2030

| 2030 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 1,254 | 1,538 |

| 2nd Price Target | 1,310 | 1,620 |

Kothari Petrochemicals share price target for 2030 may be in bullish trend according to research analysts and brokerage firms, it may touch highest share price Rs 1620 in FY 2030.

Kothari petrochemicals share price target for 2035

| 2035 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 3,055 | 3,560 |

| 2nd Price Target | 3,110 | 3,665 |

Kothari Petrochemicals share price target for 2035 may be in bullish trend according to research analysts and brokerage firms, it may touch highest share price Rs 3665 in FY 2024.

Strengths of Kothari Petrochemicals

Strong Market Position: Kothari Petrochemicals is located conveniently in the petrochemical industry space with an emphasis on high-value products like PIB.

Debt-Free Status: The company has been able to manage its sources of financing well and reduce a significant expense in the form of debt by eradicating it.

High ROCE and ROE: Consequently, Kothari Petrochemicals’ efficiency and profitability can be evidenced by testing the firm’s ability to generate returns on capital employed with a return on capital employed at 41.3% and return on equity at 28.8%.

Consistent Profit Growth: This has been achieved despite the fact that the company has realized a compound annual growth rate (CAGR) of 39% on profits over the last five years.

Innovative Product Development: There is continuous investment in Research and Development, which provides the company with the opportunity to come up with new product lines.

| Join our WhatsApp Channel for latest updates | Stockmoodys |

Weaknesses Kothari Petrochemicals

Revenue Volatility: The latest numbers of-quarterly revenues show that this company may experience fluctuations in their operation, which is never suitable for a company.

Limited Product Diversification: The above equity analysis of the IWM has revealed that the company depends overly much on PIB to attain high returns such that it is vulnerable to specific risks such as changes in the market demand and competitor offerings of better substitutes.

Market Sensitivity: The petrochemical industry forms Kothari’s operational basis – thus, the business is susceptible to high raw material costs and foreign market disruption.

Low Dividend Yield: Having a low dividend yield of only 0.85% income, income-seeking investors may not find it as attractive as other stocks out there.

Dependence on Domestic Market: Although there has been diversification through international operations, a significant part of volume comes from operations in the domestic market and is thus vulnerable to domestic economic cycles.

Future Plans of Kothari Petrochemicals

Product Expansion: The company intends to add a new product in the production line other than PIB in order to spread the risk of operation.

Geographic Expansion: There are plans to diversify sales and enter new foreign markets to enhance revenue generation.

Sustainability Initiatives: I think that providing a focus on the usage of environmentally friendly practices will not only be in compliance with the set regulations but also have the effect of improving the brand image in the eyes of the consumers.

Investment in Technology: A continuous introduction of new technology in the production line will enhance efficiency and, hence, the cost.

These are long term employment strategies, which are formulated to prepare Kothari Petrochemicals to operate under new conditions in the future.

Conclusion

Kothari Petrochemicals has proved to be prospective for investment because of its better financial performance, no liabilities, and more significant return indices. Nevertheless, the presence of market dependence and uneven revenues are the factors that potential investors should not disregard during the formation of their strategies to invest.

| Piramal Pharma share price target 2024 to 2030 | Read More… |

| Kwality Pharma share price target 2024 to 2030 | Read More… |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not investment advice.

FAQs

Is Kothari Petrochemicals an excellent stock to buy?

Investors should consider financial metrics to determine the company’s health as they make their decisions on investment.

Is Kothari Petrochemicals a multi-bagger?

There is the possibility of its growth, but as with any investment product, it is best to analyze it further since past performance is not necessarily indicative of future returns.

Who is the owner of Kothari Petrochemicals?

The Kothari family owns the company, and it has been established and managed by them right from the start.

Is Kothari Petrochemicals debt-free?

Yes, Kothari Petrochemicals has successfully eliminated its debt.

Which products are available to customers of Kothari Petrochemicals Company?

The chief item is PolyIso Butylene (PIB), which finds its utilizations in various markets, such as adhesives and sealants, plus lubricating products.