Hello friends, In this article, we will discuss those stocks in focus that will pay dividends this week. The full details of these companies are discussed below.

Table of Contents

On Monday 7th October two very known Companies Paying Dividend to its investor one is Jupiter Wagons Limited and second one is KP Energy. Others dividend paying companies and their information is given below.

Jupiter Wagons Limited (JWL)

Jupiter Wagons Limited (JWL) is engaged in manufacturing of Wagons for Indian Railway and Metro trains. Railway related stocks has given Multibagger returns in past. This company also has delivered a great return in last 5 years.

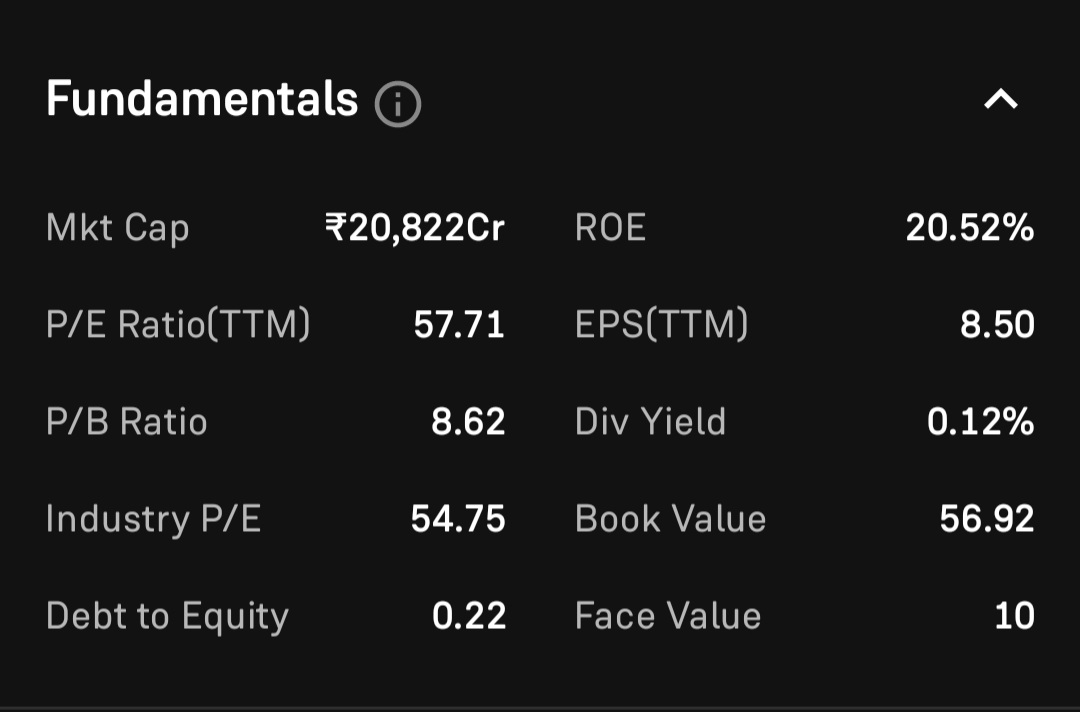

JWL has market cap of Rs 20,822 crore. P/E Ratio of this is 57.71 while the Industry P/E is 54.75. Debt to Equity ratio is 0.22 which indicating the company has low debt. Dividend yield is 0.12% and Return on Equity is 20.52%.

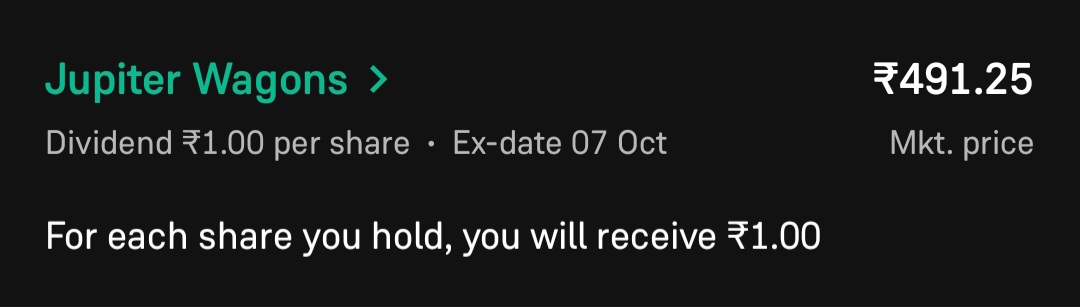

52 week high of JWL is Rs 748.10 and 52 week low is 266.80 Rs. Currently the share of this company is trading at 491.25 Rs.

The company has given 55.61% return to its investors last year. In 5 year company has given 3512% return.

JWL has announced Interim dividend of Rs 1.00 to its shareholders on 7th October 2024.

KP Energy Limited (KPEL)

KP Energy Limited (KPEL) is a subsidiary company of KP Group, engaged in developing solar and wind energy projects in India. The company has 93.59% of total revenue from infrastructure revenue and 5.6% revenue from sale of power and rest from others.

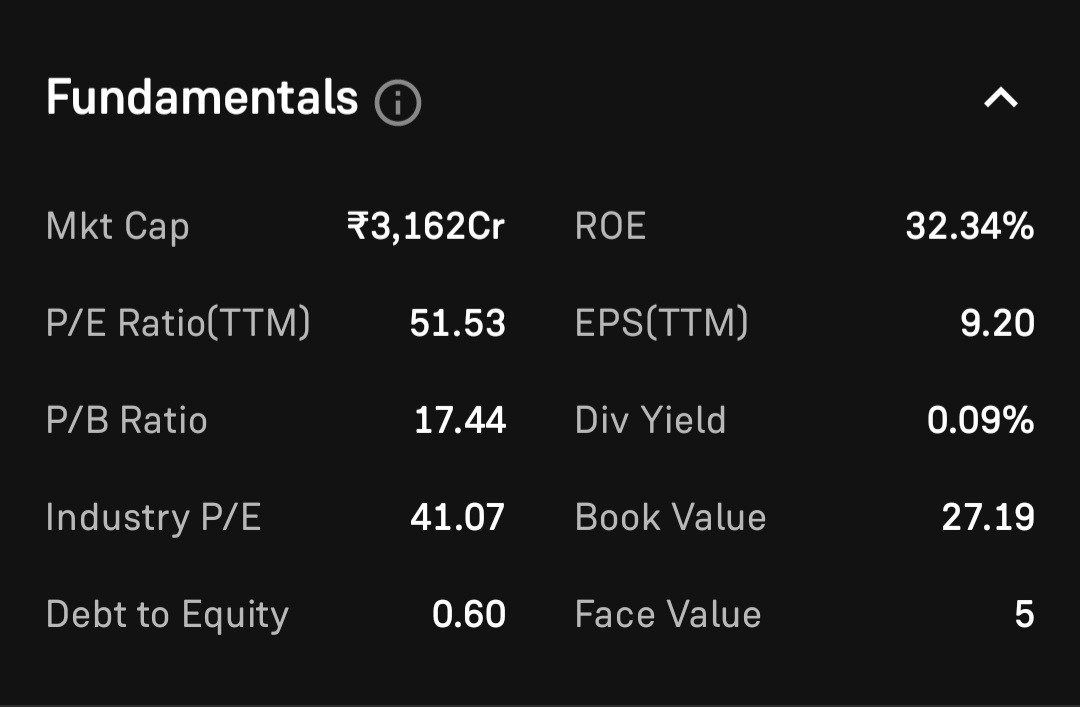

KP Energy has Market Cap of Rs 3,162 crore. It’s P/E Ratio is 51.53 while industry P/E is 41.07. The company has Debt to Equity ratio 0.60 and Return on Equity is 32.34%. The company has dividend yield of 0.09%.

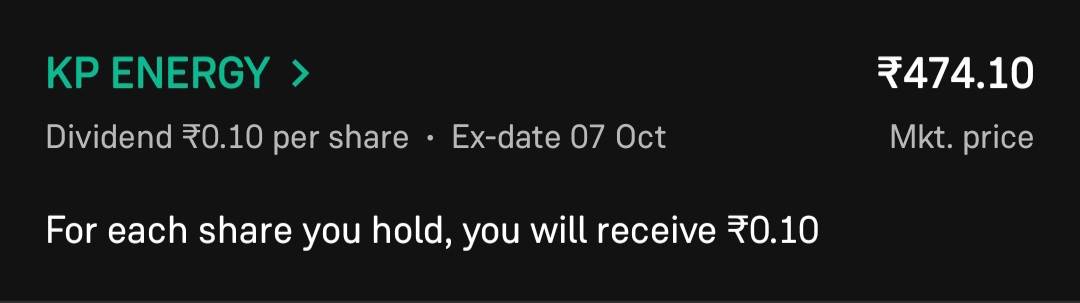

The share price of KP Energy is trading at Rs 474.10. It’s 52 week high was Rs 513.90 and 52 week low was 160.67 Rs.

KP Energy has given 131% return in last one year while 1601% return given in last 5 year.

KP Energy Limited has announced Final dividend of Rs 0.1%, which is 2% of dividend percentage.

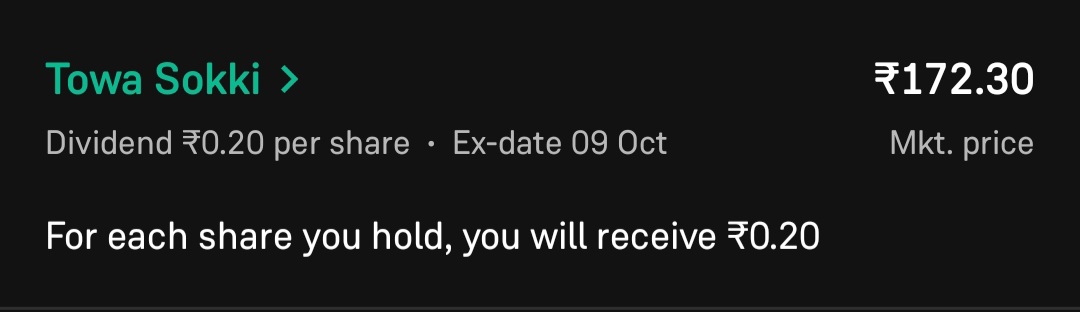

Towa Sokki

Towa Sokki is a Gujrat based company engaged in business of different types of measuring instrument.

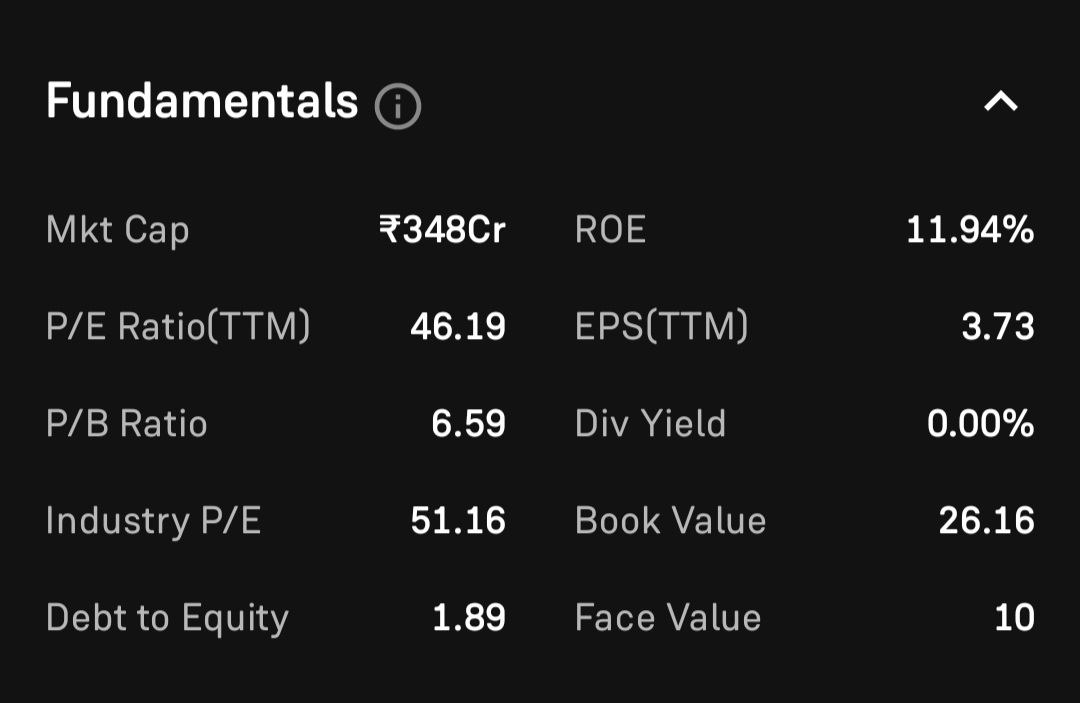

Towa Sokki has a market cap of Rs 348 Crore. P/E Ratio is 46.19 while industry P/E is 51.16. The company has debt to Equity ratio is 1.89 and Return on Equity is 11.94%. The company has dividend yield 0.00%.

The share price of Towa Sokki is currently trading at Rs 172.30. 52 week high was Rs 213 and 52 week low was Rs 36.50.

The company has given 311% returns in last one year and 3032% returns in last 5 years.

Towa Sokki has announced Interim dividend of Rs 0.20 for each share. Ex-date is 09 October 2024

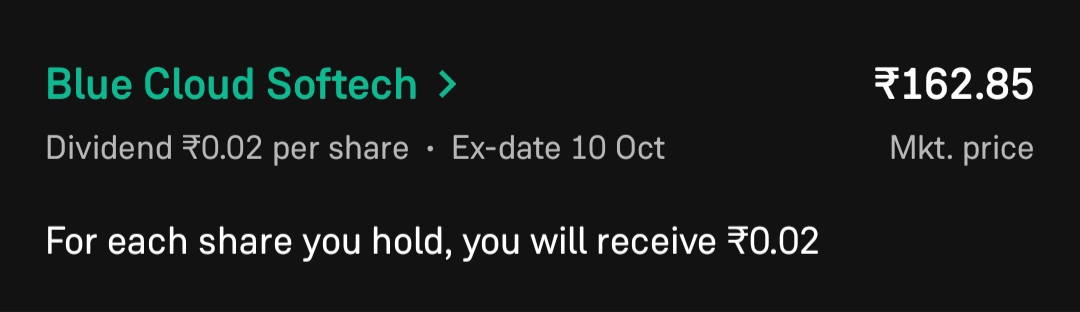

Blue Cloud Softech Solutions

Blue cloud Softech is a IT service provider. After the fed interest rate cut in September 2024 IT companies are booming.

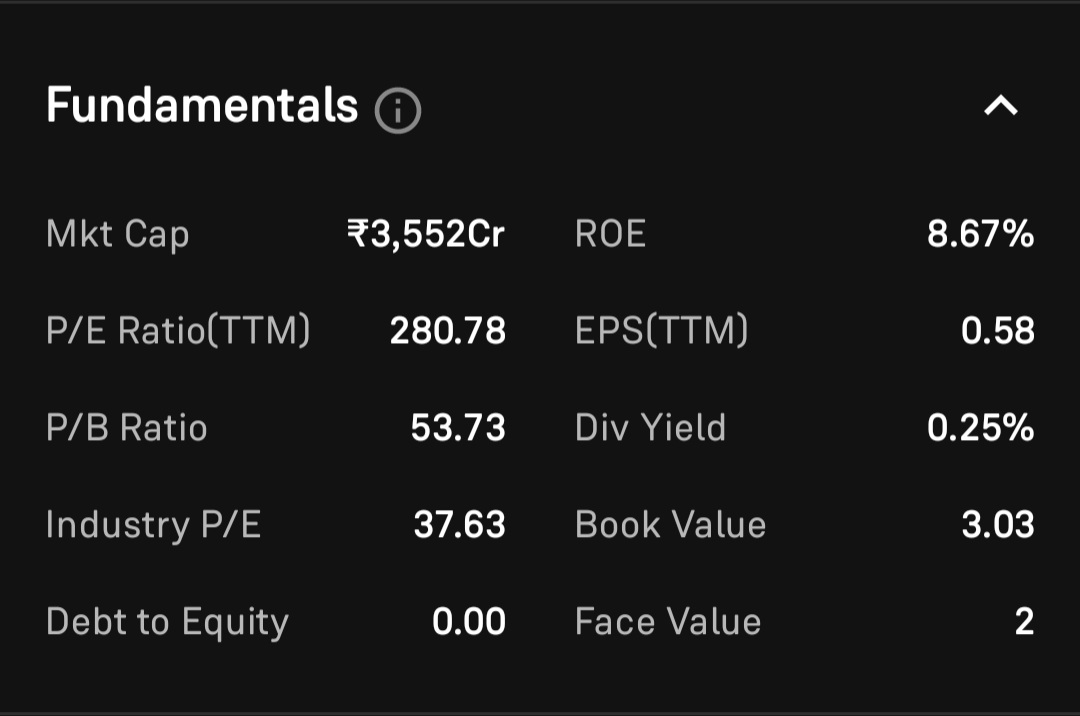

Blue Cloud has a market cap of Rs 3,552 Crore. P/E Ratio is 280.78 while industry P/E is 37.63. The company has debt to Equity ratio at 0.00 and Return on Equity is 8.67%. The company has dividend yield 0.25%.

The share price of Blue Cloud is currently trading at Rs 162.85. 52 week high was Rs 261 and 52 week low was Rs 46.08.

The company has given 108% returns in last one year and 1257% returns in last 5 years.

Blue Cloud has announced Final dividend of Rs 0.02 for each share. Ex-date is 11 October 2024.

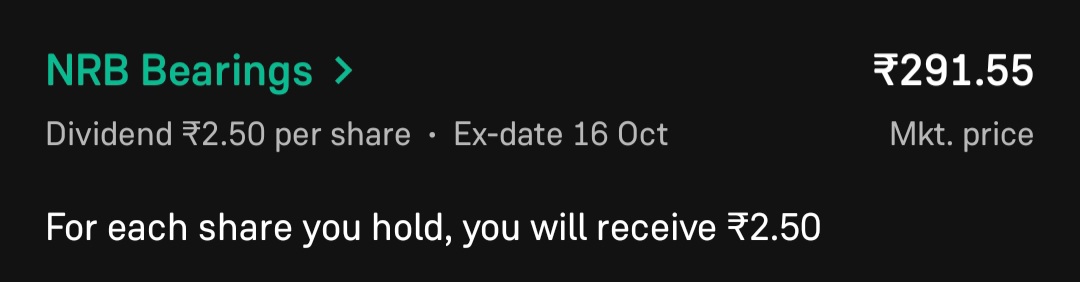

NRB Bearings

NRB Bearings is a global player in manufacturing of different types of bearings like needle bearings, cylindrical roller bearings, taper roller bearings and thrust bearings. NRB Bearings was the first manufacturer of needle bearings in India.

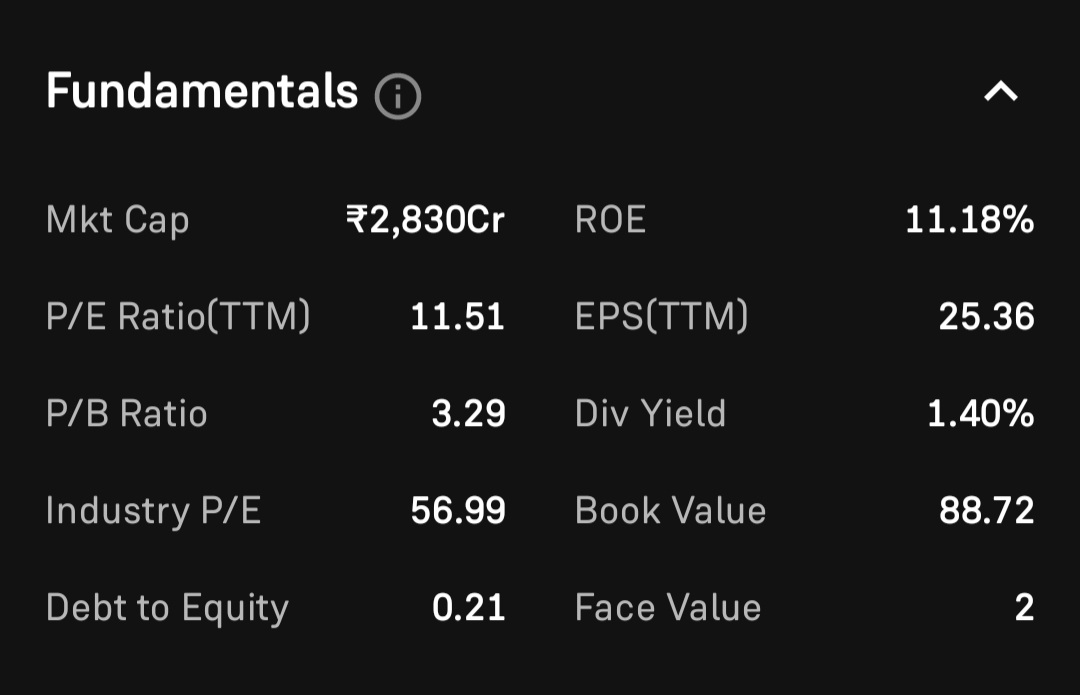

NRB Bearings has a market cap of Rs 2,830 Crore. P/E Ratio is 11.51 while industry P/E is 56.99. The company has debt to Equity ratio at 0.21 and Return on Equity is 11.18%. The company has dividend yield 1.40%.

The share price of NRB Bearings is currently trading at Rs 291.55. 52 week high was Rs 401 and 52 week low was Rs 245.

The company has given 6.76% returns in last one year and 215% returns in last 5 years.

NRB Bearings has announced Interim dividend of Rs 2.5 for each share. Ex-date is 16 October 2024.

| Join our WhatsApp Channel for latest updates | Stockmoodys |

| Join our Telegram Channel for latest updates | Telegram |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not investment advice.